usd

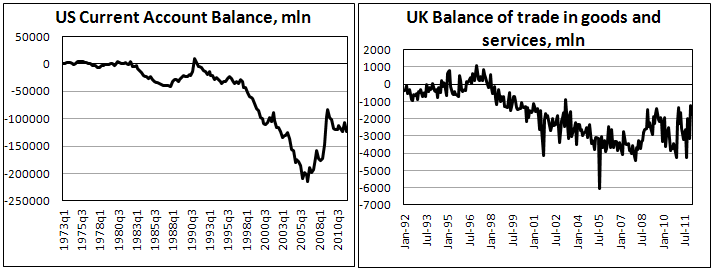

Yesterday the dollar managed to take some more gains against most of its rivals. In particular, the single currency fell to 1.3020 against 1.3060 a day before and overnight even closely approached 1.30. It should be mentioned that now interest in the dollar is triggered by a bit different factors than in the midst of the crisis. Now the U.S. currency is bought as an instrument for investment in the U.S. markets, which are currently showing a better growth than the European ones. At the same time the large emerging markets are either trying to limit the capital inflow to their countries (Korea, Brazil) or suffering a serious economic slowdown after the excessive boom (Russia, China, India). In addition, other traditional high-yielders have ceased to be that high-yielding, and investors are currently considering the chances of the further policy easing (Australia, New Zealand). So, the carry trade, we knew before the crisis, is not in that great demand any longer. Of course, we do not say that the currencies have ceased to fluctuate on the interest rate changes, but the range has definitely become narrower. This has been clearly observed since the 4th quarter of the last year until now. Despite the speedy growth of the global economy and a fairly impressive rally in the stock markets, the dollar index has been growing pretty well over the past three weeks and is now close to 80.65, just as at the end of 2008, in the first quarter of 2010 and at the beginning of 2011. Regarding this, can we say that the world has turned topsy-turvy? Of course not. Simply with regard for the recent data it seems to be very probable that the rate in the U.S. will be raised earlier than in Europe, Switzerland, Japan, and that because of the rise in the Asian labour cost the U.S. companies will be more concentrated on the development of domestic production, thus saving on transport costs and delivery time. Consider the facts: despite the high cost of energy (similar to that of mid 2008), over the last quarters the U.S. current account deficit has been reduced by 40% compared to what was before the Great Recession. At the same time, China's trade surplus has severely declined. This is that much talked-about rebalancing. However, it's proved to be much longer and more painful than expected.

GBP

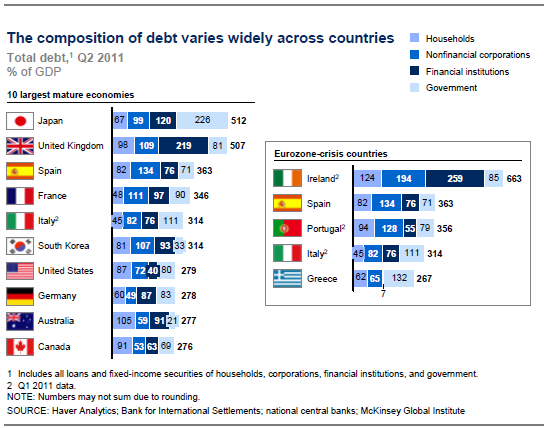

Our story about the carry trade can't but be amplified by the description of the situation in Britain. This country is also in a dire need of rebalancing. And this need is even more desperate than in the U.S., as the British total debt is much higher due to the large debt of financial institutions and households (507% of GDP as against 279% of GDP in the U.S.). Besides, the British are now suffering a serious deterioration of their living standards, as income growth lags behind inflation. It is a painful process, but already now there is an obvious improvement in the balance of payments accompanied by producers' claims about a serious increase in orders, which over the next 3-6 months is certain to significantly strengthen their positions. Exactly for this reason (the capital inflow) the pound looks stable now, despite the absence of any impressive economic performance. As to the long-term perspective, Britain as well as America has started to work off its debts, and it should be noted that it does it much better than many other countries (compare with the defaults of Russia, Latin America and the debt restructuring in Greece). This is why the sterling may do pretty well as a stable currency in the long run.

JPY

Japan also has the glorious past, but the glorious future is hard to discern now. The government is fettered with the high debt load (226% of GDP). At the same time it's getting more and more difficult to rely on the further debt financing by means of household savings. The ageing of population has led the country to the point where there are too many retirees, who don't work and save, but just spend. This is why the bank of japan should take a more active stand to revive the economy and reduce the government debt load as soon as possible. Time is working against Japan. Here we stake on the cheap yen, which is sure to support exporters.