EUR/usd

Yesterday's EU PMIs stirred pleasant surprise in the markets. Almost all preliminary indexes ( for Germany, France, the eurozone) proved to be in the green area, surpassing all the expectations and preceding values. The Composite PMI for the eurozone in general grew to 54, which is beyond the expected and previous 52.8. These data put considerable influence on the course of trading and changed attitude to the single currency. The pair managed to recover from the unreasonable selling before the beginning of active trading in Europe. Then bears pushed eurusd down to 1.3437. On the tide of positive EU statistics the pair rose as high as 1.3484. But closed the day more modestly, at 1.3460, just where it opened it. However, the US statistics were also eloquent. The weekly unemployment claims decreased to the lowest level for 8 years. Last week they totaled 284K instead of the expected growth from 303 to 310K. The number of continuing claims shrank to 2.500bln and this is the lowest level since 2007. Note that then the economy was growing within the trend and certain problems could be seen only in the construction sector , which by that time had been suffering decline in home sales for half a year. If the current data are not a one-time emission, it reflects not only stabilization of the labour market, but also proves that it is already heated to a certain degree. Under such conditions it is not surprising that the pair is still in the downtrend, which has been clearly seen for two weeks already. However, pullbacks are certain to occur here. It is also possible that today we will witness how profits from USD purchasing will be locked in. Especially, if the Ifo's Business Climate, like PMI, will show its stability against the geopolitical tension.

GBP/USD

Yesterday the sterling suffered a lot. The pair was long walking a tightrope, staying on a support level, and yesterday it tumbled down, breaking through 1.70. Generally, it met our expectations, highlighted in our yesterday's report. This morning the cable is trying to put itself up and return back within the range. However, we'll risk to suppose that the former support can now become a very strong resistance. Now it is passing near 1.7030. Besides, today we have one factor, which can tell seriously on the course of trading. The Preliminary GDP stats for the second quarter are to be published. They are expected to show further impressive economic growth of 0.8% and acceleration of the annual rate from 3.0% to 3.2%. If the expectations are not met (and they, in our opinion, are more than optimistic), the cable can be well pushed down from the current 1.6990 to 1.6950.

USD/JPY

The Japanese yen keeps making attempts to return to its 200-day MA. The main reason for growth of the pair is appreciation of the US currency against growth of the markets and strong macroeconomic statistics from the USA in the background. Yet the Japanese statistics don't arouse any optimism in the markets. Comments in the financial press speak about inflation slowdown. Anyway, it was all within expectations (and even a bit less), moreover against quite serious levels. Thus, the total consumer inflation in the country made 3.6% in June. July's data for Tokyo proved to be lower – 2.8%. But such slowdown is quite predictable, as the preceding upsurge was based on the one-time tax increase.

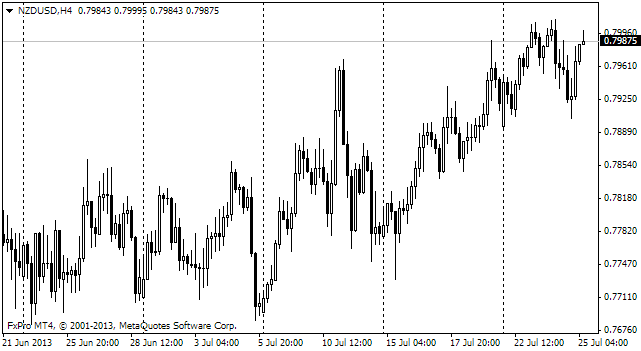

NZD/USD

The Kiwi is recovering after yesterday's selling. To be more exact, is trying to recover against Friday's weakening of the US currency. The pair has been consolidating at 0.8570. It's quite possible that the pair will meet the beginning of the next week above 0.8620.