EUR/usd

EUR continued its upsurge yesterday. After a futile attempt to take the pair below 1.36 on Thursday morning, it shot up by almost a figure. Last night there were other attempts to reach 1.37, which also failed. The bullish mood of the market is seen in the decreasing pullbacks after reaching the upper mark. It is largely a consequence of the generally positive mood in the stock exchanges, where the US and EU assets are in good demand. Our downtrend has been finally broken. Now the euro/dollar is trading mainly flat, judging by the line of resistance. The support line, on the contrary, has been sagging deeper and deeper since late December, which kept us thinking bearish. Actually, the bearish scenario is still relevant, but the date of its implementation has been postponed. From the fundamental viewpoint the euro gets support from stabilization of the banking sector of the region or from the better macroeconomic indicators. It is true that they are worse than those of the USA and Britain, but these countries already face slowdown of the growth momentum, while Europe is right on the way of picking it up. Technically, it is still important to break through 1.37 and consolidate above it. It will open the way to 1.38. It's a good thing that the market has been consolidating for a long time, thus collecting strength for a jerk up. In our opinion, the market's attempts to get to 1.3770/3800 will eventually kick out all unnecessary bears and thus will let bulls throw off their euro assets and switch to the US currency. When all market players turn in one direction, it is hard to find a reason for movement. It appears when assets go from one pocket into another. It is exactly what should happen due to the false upsurge, assuring lots of traders about further growth of the single currency.

GBP/USD

The British currency also performed well yesterday. gbpusd managed to get above the preceding yearly high and reach 1.6670. The pair hasn't been at that level since April/May 2011. Then it spent there just a couple of days. In 2009 it held to that level for fourteen days in total (in August and November). And until October 2008 the pair was steadily above it. Then the pound was stronger than the dollar, because the BOE was raising the rate more actively than the US Fed, trying to curb the boom of mortgage lending. The current situation doesn't seem to be the same. In our opinion, it is hardly possible that Britain will start toughening the policy earlier than the USA.

USD/JPY

The pair still hasn't started growing despite the optimism of the stock markets in the developed countries. The pair has been running a series of the descending highs and lows for more than a month already. Behind this we see speculations on the profit repatriation by export-oriented corporations. And they really have the stuff to repatriate due to the yen's impressive weakening since the end of 2012. Anyway, the trade and foreign deficit remain negative, which eventually should play against the Japanese currency and stir its selling.

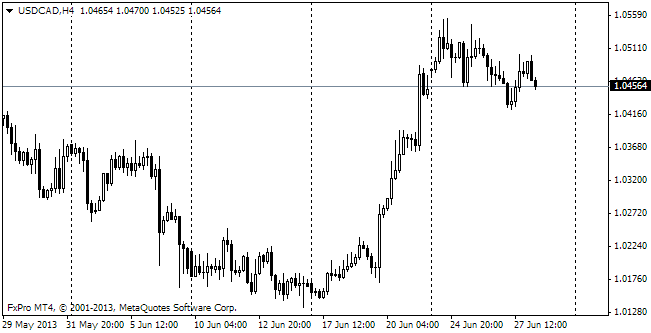

USD/CAD

The Canadian Loonie is getting momentum. Now the pair has slid to 1.0950. The pair has given back a quarter of its growth since September and 40% off the December lows. It looks promising, but we should understand that such a way down is impossible without stops. One of these is probably very close, at 1.0930.