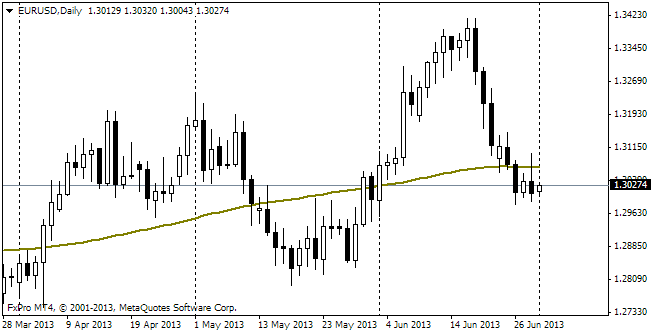

EUR/usd

The bears keep the market under vigilant control. The attempts of the single currency to recover and get above 1.31 have failed. This level is the start of Friday's selling, which eventually brought eurusd to 1.2990. Then, the second fall below the 200-day MA is also of big importance and is likely to increase the camp of bears. Those, who staked for growth, can be happy that the month and quarter were closed above 1.30. Yet, the main fight for the levels and trends for the coming weeks will take place only closer to the end of this trading week. On Thursday there will be the ECB's meeting and press-conference and on Friday we will learn data on the US employment in June. The press-conference will hardly bring any changes, but the employment statistics may prove to be not as good as was expected a month or two ago. Employment is growing slower and slower. If the actual data turn out to be within the forecasted range (150K), it will mean that the labour market grows at the below-the-natural rate, which will scarcely be to the Fed's liking. However, we should understand that payrolls is a less predictable indicator. Fundamental indicators generally signal about possible decline of the dollar (growth of EURUSD), while technical indicators mostly point at the possible continuation of the decline. Since the trend under consideration is not long-term, it will be more reasonable to rely on the technical analysis. Anyway, the situation is far from being definite, so we recommend abstaining from active actions at least till Thursday.

GBP/USD

The sterling kept appreciating on Friday. As news on the country's economy has been positive or neutral lately, there remains only one reason for the persistent pressure: Mark Carney. In our opinion, the hopes set on the new head of the BOE are too high, namely active measures with regard to stimulation of the economy. Even Draghi didn't dare to cut the rate at the first meeting under his chairmanship. If you want, we'll bet that Carney will turn out to be more conservative as expected by the markets, so there's no sense in shorting the sterling.

USD/JPY

The pair keeps ascending. Now it is quoted at 99.30. It is remarkable that it should grow mainly on the upsurge of the dollar. Today's Tankan statistics proved to be positive for the first time since 2011, but the yen hasn't reacted yet. It will hardly be a steep rise, it's more likely that we will see gradual buying with the quite probable target above 100.

AUD/USD

The aussie with one big step cancelled out all the consolidation and retracement of the last week. On Friday the pair fell to 0.9110, that is the lowest level for almost three years. Some commentators say that there is still some potential for the rate cut. Anyway, the RBA will hardly do this tomorrow as the pair has lost 6% over a month and 12.5% over two months.