EUR/usd

Putin toned down his rhetoric concerning the Ukraine and withdrew the troops back to the base, ending the training exercise. The markets breathed a sigh of relief. In the beginning this news provoked growth of eurusd on the recovery of demand for risky assets. But since the pair wasn't sold heavily on escalation of the conflict, it wasn't purchased much after it had eased. The pair managed to rise to 1.3780 from the daily low of 1.3720. Besides, the US S&P 500 hit a new historic high and the Russian stock exchanges recouped half of Monday's losses. Why not all? Because the conflict hasn't been completely resolved and Americans haven't dropped the idea of imposing sanctions yet. The threat of strengthening confrontation will weigh upon the markets for a while, making them flinch every now and then. Anyway, those who trade the euro/dollar are now more interested in the US employment statistics and tomorrow's press-conference of the ECB. Today we expect ADP's report on non-farm employment. After the preceding two months when this indicator proved to be much better than the official data, it is now forecasted that it will demonstrate a modest growth of 159K. The stronger data and downward revision of the previous statistics may support the US currency. A bit later there will be a release of the ISM Non-Manufacturing PMI. It is expected to show slight slowdown from 54.0 to 53.8. In our opinion, modest expectations leave a better chance for actual data to come out better and support purchasing of USD.

GBP/USD

The British construction sector failed to maintain its former growth pace, according to the PMI report. Anyway, the current rate of 62.6 is still high enough, even if it reflects the decline from 64.6. Today Britain will get fresh data on a more important PMI for the country – that of the services sector. This indicator is also expected to demonstrate slight decline, but still without a threat of falling from the high levels. This run of events promises another quarter of impressive economic growth, which is sure to support the British currency. Or else the high sterling will be punished by the markets.

AUD/USD

Just a bit more than a month ago bad news on Australia was coming in abundance. At the end of February the trend seemed to change. Apart from the change of the RBA's sentiment from dovish into neutral, we deal with better economic statistics. The labour market is still lagging behind, but consumer activity and the housing market are reported to liven up. Today's GDP statistics for the 4th quarter showed that in that period economic growth made 0.8% and against the same quarter a year ago – 2.8%. Let's suppose that the Australian economy has lived through its most difficult period, so the next step of the RBA will be to increase the rate to cool the overheated housing market.

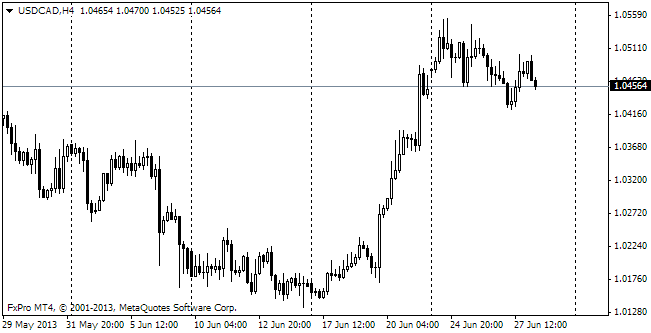

USD/CAD

The Canadian Loonie is to face the release of the interest rate decision today. There will scarcely be any change in the policy, but the tone of the commentary should be taken into consideration. It's quite possible that the Bank of Canada may surprise shifting the accent from the weak aspects of the economy to the unfolding recovery, just like the RBA.