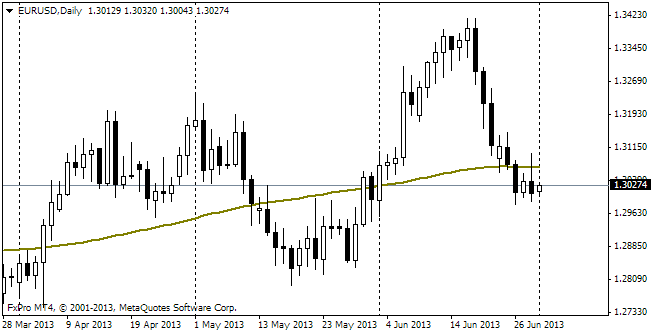

EUR/usd

The dollar keeps getting weaker. It's depreciating against all those currencies, which were the weakest in the first half year. Anyway, eurusd is also distinguished by growth. Yesterday the bulls managed to “probe” 1.34. The pair was that high as far back as the middle of last June. Earlier we mentioned it more than once that the pair shouldn't have any problems with breaking through this level. It's even possible that the bulls will push the pair up to 1.36, which corresponds to the annual highs, but the further prospects of the pair depend on lots of factors, the majority of which remain unrevealed so far. Thus, it is still unclear how steady the European growth is. But the most dangerous thing is that it is not clear how the fomc looks at the rollback of the bond-buying programme. Our opinion is still the same: the beginning of the stimulus rollback is likely to fall on December. This month Bernanke has taken the most radical measures to extend the stimulus. However, there is one more factor. This is the change of the Fed's head, which will take place next January. It's quite possible that just like in case with the BOE the Committee will refuse to change the policy waiting for a new successor. But it is not for sure, as we don't know the name of the future chairman of the Fed yet. Let's put sentimental talks aside. Our target to reach 1.34 has been achieved. Now it seems that the most reasonable strategy is to abstain from big purchases as the Friday factor may go off, that is correction of the current positions after a strong movement.

GBP/USD

The sterling is running ahead of the single currency, making up for the previous weakness. gbpusd feels more confident above 1.55 and EURGBP is again trying to break below 0.86, but unsuccessfully so far. But it is not that important, the really important thing is that the cable is trading at its 200-day MA. In June there already was one futile attempt of the pair to break above the key line. However, it didn't manage to consolidate there and then lost nine figures over about three weeks. Yet at that time the 200-day MA passed through 1.57 instead of 1.5530 as now.

AUD/USD

The aussie keeps getting support despite not very hawkish claims of the RBA. In its regular quarterly Monetary Policy Statement the Bank cut the estimated economic growth rate for this year to 2.25%, while three months before it promised growth of 2.5%. But it little bothers the markets, which take their trading decisions regarding the Aussie, basing on the stats from China.

USD/CHY

The Chinese Yuan is setting new highs against the dollar (i.e. the pair is falling). This happens much due to quite favourable data on the industrial production (acceleration to 9.7% y/y) and also due to fixed asset investments exceeding the forecasted rates. Here we observe growth by 20.1% for the first seven months of this year as compared to the same period a year ago. Thus, China's lending may turn out to be not so hard as was feared just a few months before.