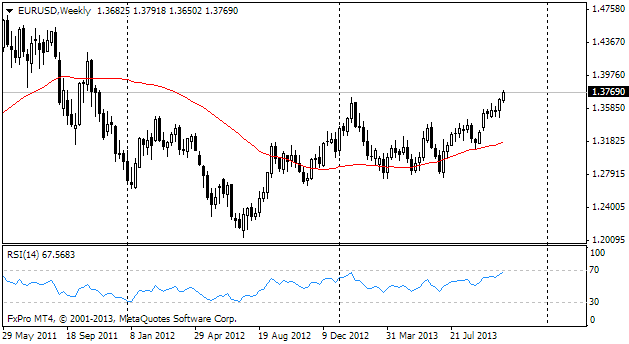

EUR/usd

The payrolls caused much trouble to the dollar. The employment stats were poor enough for the market participants to sweep away all thoughts about the stimulus tapering by the Fed in the near future. Yet, the negative news on the labour market didn't drive the markets into pessimism as stock markets were growing. The US dollar tumbled down to the 23-month low against the euro. From Tuesday's low of 1.3660 eurusd has already grown to 1.3790. According to the published statistics, the number of new jobs increased by 148K against the expected 180K. The unemployment decrease to 7.2% again occurred due to the reduction of economically active population. This indicator dropped to 63.2 against 63.6 a year ago, yet over the month it hasn't changed at all. Unemployed Americans are losing hope and leaving the ranks of job-seekers, which spills over into unemployment decrease against employment growth below the natural increase rate. It is also noteworthy that the average workweek hasn't changed at all, still making 34.5 hours. We shouldn't hope for improvement here as at the employment peak this indicator made 34.6. If we return to the main currency pair, we'll see that since the beginning of the recent uprise the pair has already moved 7 figures up, first because the Fed didn't reduce purchasing in September, then due to the government shutdown and now because of reconsideration of further steps of the CB. It is remarkable that the US currency eventually proved to be lower than it had been before that entire story with tapering. It is quite often the case in the markets: too high expectations and the following disappointment result in unreasonable pricing for a while. And only when the idea is not new, quotes get reasonable. Something like that is expected now. The dollar has significantly declined, also because the Treasury, when increasing cash, borrowed money from public funds, thus keeping liquidity in the markets, otherwise extraction of 380bln for less than a week would have produced a serious impact on the markets. Now the borrowing process is likely to be smoother and lead to appreciation of the US currency.

GBP/USD

Just like the euro, the sterling also suffered heavy growth after the release of the US employment statistics. However, the cable failed to break through the preceding high. The growth stalled at 1.6250. Probably, we will see the double top forming. And taking into account that the year started approximately at these levels, it can be even the triple top. As in case with the euro, we are pessimistic regarding the pair's prospects. From July's lows the pair has already grown by 14 figures.

USD/JPY

The bears have broken the pair. The Japanese currency was being sold well even despite heavy selling of USD. It looked reasonable as the markets were growing and bond purchases required rather ‘cheap' yen loans. The pair managed to reach 98.47 and soon went down. Now trading is held at 97.40. It is explained by profit-taking in EURJPY, which yesterday hit the four-year high.

AUD/USD

The aussie reached our target (the 200-day MA at 0.9750). In its final jerk it was supported not only by the US employment stats, which undermined strength of the dollar, but also by strong inflation. Instead of the expected growth by 0.8%, CPI rose by 1.2% in the third quarter. Thus, the annual price growth made 2.2% against 2.4% a quarter before. Inflation slowdown proved to be less strong than awaited by the RBA and that ruined all hopes for the rate cut in the near future. Anyway, the profit-squeeze crossed out all that growth and now the Aussie costs 0.9640USD.