EUR/usd

The single currency was put under heavy pressure after the release of Germany's inflation data. eurusd dipped down to 1.3800, formally leaving the gap uncovered: the high was hit at 1.3878. As expected, Germany's consumer inflation proved to be lower than forecasted by the experts at the beginning of the week. The annual rate of price growth in the largest German economy made 1.3% against the expected 1.4%. This acceleration against last month's 1.0% y/y was provoked purely by the low base effect as in April the prices tumbled by 0.2%. The ECB members often say that the long period of low inflation bears negative consequences for the economy. Thus, the poor data on prices heighten expectations of the policy easing by the ECB in the near future. This easing is sure to do good to the economy, but we can hardly count on it while the region is demonstrating economic activity recovery. The easing requires two simultaneous factors: a shock for the economy or the financial sector and space for maneuver on the side of inflation. Now we have only the second factor. Only growth slowdown will probably help to weaken the euro. However, the PMI and Ifo's indices, released last week, proved to be quite favourable, so in search of moments of weakness in the EU locomotive, players have turned their attention to the employment statistics and also keep an eye on the estimate of the EU CPI in April. Today the risk is posed by the ADP's employment statistics, the preliminary GDP for the USA and fomc's decision on the interest rate and the QE programme. Each of these events has the potential to produce significant influence on trading. It is not excluded that they will have different sphere of influence, to say nothing about the geopolitical risks. Fasten your belts – the markets can be shaken a lot.

GBP/USD

The British economy grew by 0.8% in the first quarter and by 3.1% against the same quarter a year ago. The perfect rates, anyway, failed to meet the forecasts, which provoked the initial correction in the pair. Yet, with time, analysts understood that the stats were pulled down by the agricultural sector (-0.7%), while the services sector and manufacture showed the highest quarterly growth for 11 and 16 quarters respectively, and construction added 0.3%. At the moment it is simply impossible to discover the points of the pound's vulnerability. Probably, only the US statistics will make the dollar more attractive.

USD/JPY

The Japanese yen was under pressure yesterday and usdjpy went as high as 102.70 with the milder-than-expected sanctions against Russia in the background. Yet, it didn't ease the situation in Ukraine, which today has pushed the pair below Tuesday's levels. The BOJ's decision, as expected, didn't bring about any changes in the policy.

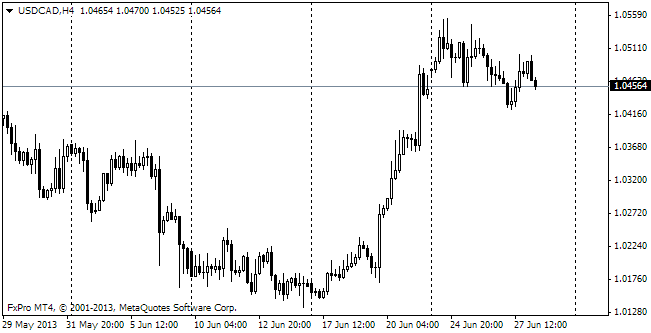

USD/CAD

Apart from the hailstorm of the important US statistics, Canada will also release its GDP estimate, though it will be monthly data instead of the quarterly ones. Yesterday the Loonie broke the support against the dollar and the pair fell from 1.1030 to 1.0950. It is quite a good rally, albeit already at the time when the US dollar is appreciating against other currencies. There is a feeling that bulls simply have loosened their grip in order to gather liquidity for the next full-scale attack.