EUR/usd

S&P is threatening to lower the ratings of almost all EU countries and many banks of the region in case ratings of the euro-Zone countries go down. Stakes on this summit are very high. But now there are some doubts about its successful outcome. Newspapers with reference to some governmental sources say that Germany will oppose an early launching of the additional bailout funds that we spoke about yesterday. Germany assigns primary importance to the fiscal discipline and agrees to come to the rescue only if it is observed. Again and again German politicians make the same mistake: trying to gain time, they only hamper the situation. Nevertheless we will see the results of the summit at the end of the week. Today the ECB meeting is on the agenda. An overwhelming majority of economists are expecting the rate cut by 25 bps to 1.0%. This outcome is already clearly visible in prices. Now the main focus is on whether the European Central Bank will express a great interest in buying the bonds of the troubled countries or not. A week earlier draghi promised something of the kind, if the decision of the summit would give him this opportunity. Once again everything depends on the greater integration of the euro area and fiscal discipline. The problem is that the ECB meeting will be held before the summit, and the Bank is unlikely to make any serious allegations not to be disappointed a day later. Bidding on the single currency day by day ends near 1.34, although the last couple of days it has been moving between 1.3350 and 1.3450. The ECB press conference could help to come out of this narrow corridor, but President Draghi's confusing speech is very likely to keep the main focus of the markets on tomorrow's summit, before the outcome of which traders can't buy or sell.

GBP/USD

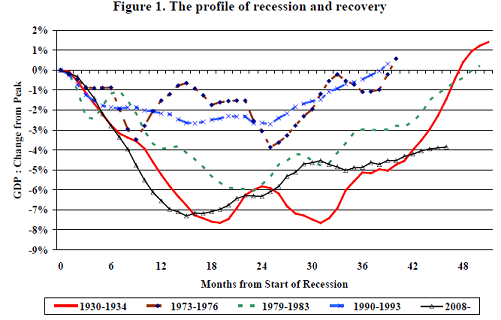

British manufacturing sector was not very impressive, having lost 0.7% in its output in October. It fell beyond everyone's expectations, but still went in line with the general tendency to stagnation or to a certain decline in production caused by the problems in Europe and by the global slowdown. Despite this the UK growth estimates by NIESR marked an increase of 0.3% over a period of three months ending with November. It is a slight slowdown after 0.4% over the three-month period ending with October. If there isn't a sharp decline in December, Britain can still show positive growth in the fourth quarter. Attention is drawn to the fact that recovery from the recession has almost ceased: in the deeper recessions of the past and during that one in the early '90s, the economy was able to recover much faster. We tend to blame aging of the population which generally reduces labor mobility and increases government liabilities. Already for 7 days on end the gbpusd is trading between 1.56 and 1.57. The sterling is still vigorous enough to grow on the market strengthening, albeit not very quickly and actively. Yesterday just after the American markets stopped slackening the pound rose from the bottom of the corridor to its top. But for breaking up the resistance it's necessary to wait for the decision of the Bank of England; the latter could surprise with an unexpected expansion of QE. However, it is a very unlikely outcome.

USD/JPY

Uncertainty of stock markets affects the position of usdjpy. The pair has been falling for 4 days in succession, although the fall can't be called very serious. Now the pair is trading at 77.60 against the yesterday's level of 77.70. As often happens, a sea of statistics published on Japan hasn't caused even the slightest movement of this pair in Forex. It's worrisome that there has been a significant reduction in core machinery orders (-6.9% m / m). It signals the lack of confidence in industry and promises the further anemia of the economy.

AUD/USD

aussie, as well as the whole Forex market these days, is trading in the narrow channel. Its passage is also equal to one big figure: the trade is focused between 1.02-1.03. Now the pair is right in the middle, despite disappointing labor market news. By the way, at a closer consideration this news has turned out to be a bit worse than it has been implied by the headlines: an increase in unemployment from 5.2% to 5.3% and an unexpected decline in employment by 6.3K. The problem is that behind that decrease there is a 39.9K reduction in the number of full-time employers and a 33.6K increase of part-time employers. Companies prefer to play safe as it's easier to shorten the working day of part-time employees as well as to fire them.