EUR/usd

EUR/USD is trying to break above the channel, where it has been consolidating in the recent days. Now the bulls are striving to reach 1.31. But it seems that the fate of these attempts will be decided by the German ZEW. If it goes far beyond the forecasted rates, the scales will be tipped in favour of the euro. Yet, it should be mentioned that already now this indicator is at quite favourable levels. In the evening the markets can be also affected by the US inflation statistics, but these data have been pushed to the sidelines, since the Fed relies more on the employment statistics in its policy. And there are no significant shifts there. The stats are good enough to put America in a favourable light against other developed countries, but are too weak for the Fed to announce the stimulus rollback already in September. Europe is still facing scandals concerning high officials. Spain's Prime Minister Rajoy is forced to resign, but he refuses. Let's see what will be further, it's hardly the end. In the meantime, the dollar index has come off the highs, but is still much above the support of the recent uptrend. To break through it the index should decline by other 2%, which in eurusd means the move above 1.3350, but from there it will be but a step from 1.34, which was the high of the end of June. In our opinion, the move towards this zone is quite possible in the coming couple of weeks, but further growth is still in doubt.

GBP/USD

There has been a release of price statistics in Britain today. Consumer inflation has proved to be weaker than expected and its yearly rate has remained below 3.0% (the actual figure is 2.9%), thus enabling Carney to avoid writing a letter to Chancellor of the Exchequer. The British government benefits from the high inflation rate, but here it's important not to cross the border behind which households and business won't see sense in investments in the British currency. Yet, there is a feeling that inflation is a side effect of the policy of the BOE, which is tolerated in the anticipation that advantages of the treatment (or of the doping, as you like) in the form of QE outweigh disadvantages and side effects.

AUD/USD

The minutes of the RBA's meeting in July enabled the bulls to launch an attack. At last we heard from the Australian government that the aussie's decline may raise inflation due to growth of import prices. Earlier from August till April the pair had been knocking against the ceiling of 1.06 for three months before it slipped down to 0.90 (-15%). The RBA made a hint that it will be more cautious in its policy, supporting decline of the currency to stimulate the domestic production.

oil

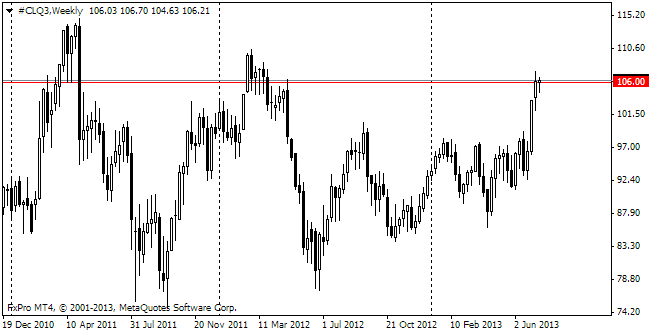

Oil, unlike the US stock exchanges, is far from its historic highs. Moreover, its dynamics has been much worse than that of the exchanges lately. Anyway, we can't but mention that Black gold is trading close to the upper bound of the range of the recent years. The rates went above $106 per barrel for WTI only for a month in April 2011 and March 2012. Probably, it is not the time to sell, but profit-taking and a wait-and-see attitude with the potential to start selling seems to be a reasonable strategy.