EUR/usd

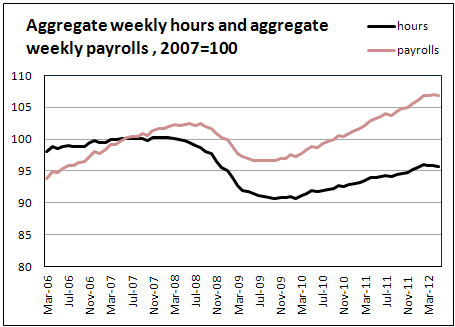

Since payroll figures proved to be poor, the likelihood of further QE has significantly grown. The US non-farm employment has gone up by 69K. As has already been mentioned, the decline in economic and employment growth is quite typical of summer months. In this connection, many economists expected that May would be a weak month, forecasting the employment growth at 150K against the average half-yearly figure of 200K. However, the reality turned out to be even harder than this. The actual figures for May-June have shown employment growth just at 69K. Meanwhile, the data for April have been revised down to 77K against the initial estimate of 115K. What is important, the average workweek has shrunk from 34,5hr to 34.4hr. At first sight, the minimal decline has reflected a serious issue. The total time worked out in May has proved to be less than in April. The dynamics of labour remuneration are also of interest. The wage increases are lagging behind inflation and keep slowing down. The annual average hourly earnings have made 1.7%. The most recent available data on inflation for April have shown a 2.3% growth. Of course, it is better than 2.9% that we saw two months ago and than 3.9% in last September. Still, the decline in real earnings will continue to produce an adverse effect on spending. Thus, already now we can see a drop in the savings ratio, which can hardly be attributed to the disposition of Americans to live on credit. They simply need more money to satisfy their daily needs. In other words, America could need a new injection of incentives to escape another slowdown. That explains why the euro after a short fight still has started growing, and the price of gold has skyrocketed from the preceding low of 1540 to 1630 just over a few hours. The single currency, which over the first few minutes was pushed down to 1.23, closed out the day above 1.24. It may eventually give rise to the short-covering rally in the euro, provided there aren't any unpleasant surprises from Europe.

GBP/USD

Not all the currencies have displayed an equally positive reaction to the troubles of the dollar. The sterling proved to be among those which failed to close the day positive, despite the growth of the pair on the release of the US employment data. It can be easily explained, if we take into account the poor Manufacturing PMI figures. The index rate for May turned out to be the lowest since May 2009, i.e. since the time of the severest recession, the disastrous impact of which is felt so far. Those who have been expecting growth in Britain after weak winter months can be utterly disappointed. Thus far the sterling has looked stronger than other majors. Now, it can prove to be the opposite way.

USD/JPY

The yen again proved to be under the impact of momentary sentiments, but eventually turned back to its traded levels. First, USD/JPY dropped down to 77.65, then jumped up to 78.60, but closed out the day at the levels which had been reported before the release of the US statistics, i.e. at 78.16, where the pair keeps trading now. Remember that it is below the 200-day moving average so the chances of further decline this week are growing.

oil

It looks as though the weakness of the US labour market had told worst of all on Oil and stock markets. Let's focus on the first one. On Friday the WTI Oil price fell down to $83 per barrel, and now the instrument is already trading at 81.64. And this is after a downfall from 106 over a month. It seems, the traders, buying Gold in expectation of further QE, are not very eager to build the growth of demand for the black gold into their rates.