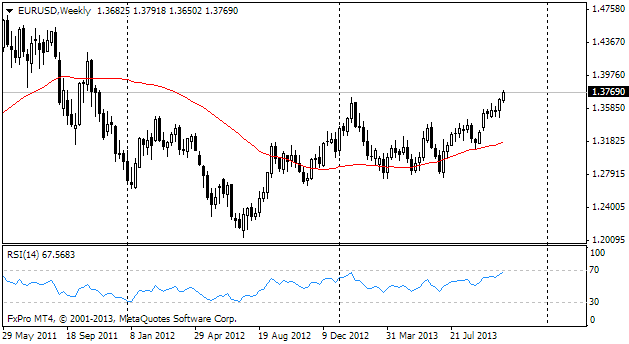

EUR/usd

Let's outline the prospects of the major currency pairs in the coming year. The euro performed well in the last quarter, considerably appreciating against the dollar and the yen. Even against the sterling its decline was not as strong as it could have been. And if we include here the rate cut by the ECB in November, the current strength of the single currency looks really mysterious. We think that eurusd is getting support from the EU banks, which store liquidity on their balance sheets to get stronger by the time of stress tests. The improved sentiment indicators in the region also help here. Yes, exactly the sentiments instead of the real economic indicators encourage purchases of the single currency now. In our opinion, the current rate of the euro (about 1.37) impedes recovery of the economy, which should eventually affect the sentiment indicators. Thus, the first three-six months of the new year may prove to be quite unfavourable for the euro, though the real economy may gain momentum compared to what it shows now. It is often the case that the economic cycle of the eurozone lags behind the US cycle by 6-9 months. Of course, if the sovereign crisis does not interfere. Speaking about the basic scenario, the budget issues of the eurozone can be treated as a risk factor for the coming year, but hardly as the basic scenario. As to trends of the currency, we suppose that in the first 3-5 months of the coming year EURUSD will decline to 1.30 and then the euro will rise to 1.40. The main idea is that this movement will be strictly within the bounds of the channel, formed after the financial crisis in the USA and the debt crisis in Europe. We have passed through the time of shocks and so return to more moderate market fluctuations.

GBP/USD

Britain's efforts to weaken its domestic currency and stimulate the economy have spilt over into the economic recovery, but not in the supposed sectors. The government and the Bank of England haven't managed to achieve any significant improvements in the trade balance and real sectors (even as far as investments are concerned). Thus, rebalancing hasn't worked out. Anyway, the housing market has become so strong that the government reduces its support and price growth is already caused by the increase in demand (yet only in some sectors) rather than by depreciation of the sterling. The pound has grown well against USD in the last half-year, but just like with the euro, we expect a pullback here at the beginning of 2014 and then – growth. The sterling has a higher potential for growth, so we believe that the pair will retrace to 1.55, but then there will be a new wave of growth to the post-crisis highs – 1.67-1.6850.

USD/JPY

With the Japanese yen we are still guided by the pace of the currency's depreciation, rather than by the economy (it is too weak to justify the incentives). Our long-standing observation for the developed countries is that authorities, both inside and outside, are tolerant to depreciation/appreciation of the currency by 20-25% over a year and do not want sharper changes. However, this pace has never been maintained for long. During the interventions in 2005 the rate was falling by 10% y/y. And it marks a move to more measured decline. So in a year the dollar may get closer to ¥115 in price, but the uptrend will be broader and more broken, especially in the second half-year.

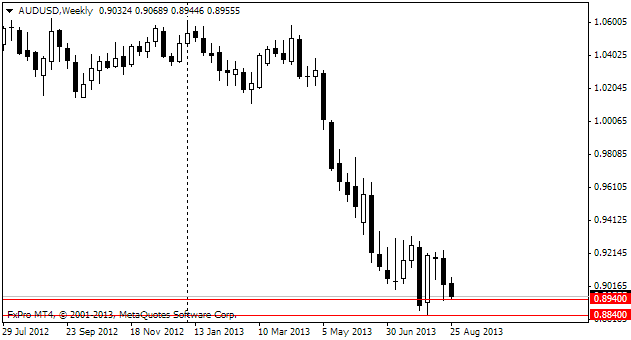

AUD/USD

The Aussie has received enough punches this year. Unfortunately, it has gained such a considerable momentum that this may go on under its own inertia for some time. The RBA's head has mentioned recently that he would prefer to see the Aussie at 0.8500. Apparently, the market will fulfill his wish and even more. We expect that in the first half-year the Australian dollar may fall to 0.8000, but already further get some support and grow to 0.90-0.93. Then already the Australian central bank may stop being that soft, getting evidence of inflation growth (especially in housing prices) and also the results of economic rebalancing in the extractive industries.