EUR/usd

The Asian stock markets showed some growth after the holidays, taking their lead from the US pre-Christmas positive mood. Yet, the yen is still under pressure. It hit a fresh five-year high against the dollar – at 104.82. audusd also opened with a gap down. Probably, it is somehow interconnected as AUDJPY hasn't demonstrated any changes – the cross opened at 93.06, where it had been before closing. So, no significant shifts. And it is quite reasonable as during the holiday time there wasn't any important events. During the pre-Christmas trading session the dollar was in demand most of the time, but in the end yielded some of the gains. Now trading is held at 1.3680 against Tuesday's low of 1.3654. Supposing that today the markets won't try to get to new levels either, the pair is likely to demonstrate moderate growth and another attempt to get above 1.37. The only important event today is a release of weekly unemployment claims, which are expected to show further growth. From the November low of 305K this indicator has risen to 379 over two weeks and, as expected now, will exceed 382, thus hitting the highest rate since March. In the meantime, the number of continuing claims isn't that big and remains at the November levels, which fits into the downtrend. In this case, what we see is strengthening of activity in the employment sector, when employees switch from one job to another. Yet, we don't know the reason – whether it is employers who want to find more advantageous workers or activization of those, who have been left without a job for so long.

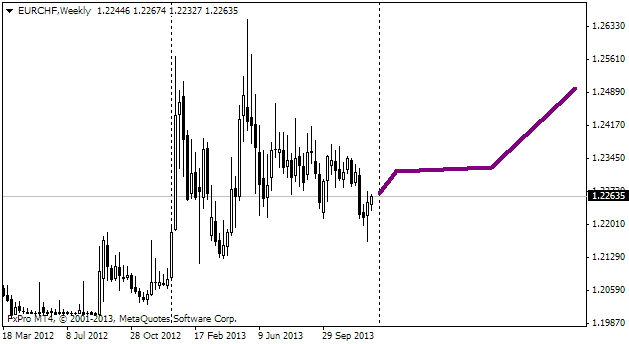

EUR/CHF

The Swiss franc enjoyed a huge demand in the recent days. Last week EURCHF declined to 1.2160, April's low, and got support afterwards. It is quite possible that behind purchasing of the franc at this level there stand speculators, who believe that the SNB will be fiercely defending 1.20. So, we suppose that the pair will return to more comfortable levels close to 1.23, where it had spent the preceding half-year before December's selling. Looking closely at the prospects of the pair in the coming year, we have a feeling that it may come further off 1.20 and consolidate at 1.25. Yet, it will occur only along with strengthening of the euro, that is in the second half-year. In our opinion, the stance of the SNB might be favourable for the euro. Staking on growth of EURCHF, traders indirectly doesn't let the euro depreciate against the dollar at a degree, at which it could in free markets.

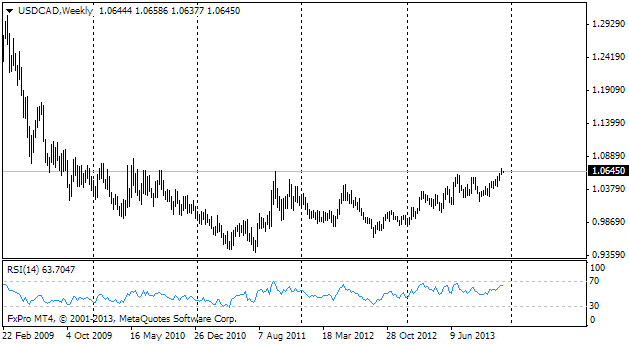

USD/CAD

The canadian dollar got a bit weaker on opening of the market and is now trading at 1.0640. It is quite far off the yearly high (1.0736), but yet within an uptrend. In our opinion, the Canadian dollar will suffer next year, continuing the trend of the recent months. We expect that usdcad will grow to 1.10 already before the end of the first half-year. After which the expected reversal of the trend and weakening of the US currency may help the pair come off the extremums and return to 1.07/08. Weakness of the currency comes from quite a slack recovery of the economy, which is suffering from the growing energy independence of the USA and also from decline of gold prices.

Gold

This instrument has done badly this year. 1180 is hardly the lowest rate. It is quite possible that it will decline further to 1100. In our opinion, Gold is getting less interesting for investors, but even being as low as 1100 it will not become the aim of bears. The global bubble of investments into Gold has burst, so what we have now is only the demand for precious metals on the part of the Asian economies with their growing consumption and also of the central banks, which have aimed at diversification and retreat from the floating currencies in the recent years. So we suppose that after 1100 is reached Gold prices will grow to 1250-1300 closer to the end of the coming year.