EUR/usd

The single currency has again fallen under pressure today. On Monday the pair hit a fresh 26-month low at 1.2438. Then the pair was in moderate demand and grew to 1.2575 at some point. Against the global growth of the dollar the single currency got support from messages that Mario draghi's colleagues are displeased with his management style and are trying to restrain his intention to continue easing the policy till the end of the year. In the recent weeks speculations have been around the dilemma whether the ECB will launch a programme of quantitative easing or abstain from it. The present forms of bond purchases look rather unconvincing as over a week the balance is growing just by a few billion euros. Two weeks ago it was 1.7bln and last week it totaled 4.8bln. Thus, the current pace of bond purchases hardly exceeds €10bln a month and will scarcely help the eurozone stimulate higher inflation. Yes, this step is enough to provoke initial weakening of the single currency, but to maintain steady weakness of the euro broader measures will be required as, above all, the current depreciation is based on expectations of further rate cuts in the eurozone. Before Draghi managed to get off with big words like ‘to do whatever it takes to save the euro'. This time the market will require real actions. Contradictions inside the ECB under such conditions go against the intentions of Mario Draghi. But on the other hand, even with such contradictions in the background, the US economy can be strong enough to push the single currency towards new lows since 2012. USD's strength can be broken today by the poor statistics from the USA. If, for instance, ADP's employment data are poorer than the expected 214K.

GBP/USD

The sterling got a haymaker this morning after the news that the Republicans had gained a majority in Congress. This state of affairs promises a new round of demand for the dollar as the Republican Party is known as the one that lobbies interests of the US business sector. gbpusd has already broken the moderate uptrend and is now running the risk of tumbling below 1.5925, which was a low last week. Further the pair can be expected as low as 1.5975.

USD/JPY

When will the yen stop falling? It looks as though bulls were trying to make the most of the current situation and sell as much of the Japanese currency as possible in view of new incentives from the BOJ and intentions of the country's pension fund to diversify its reserves in favour of stocks. usdjpy has reached 114.50 today, pushing aside all the preceding levels. The situation looks as if the market would consolidate only near ¥120 per dollar by the end of the year unless we got some extreme surprises.

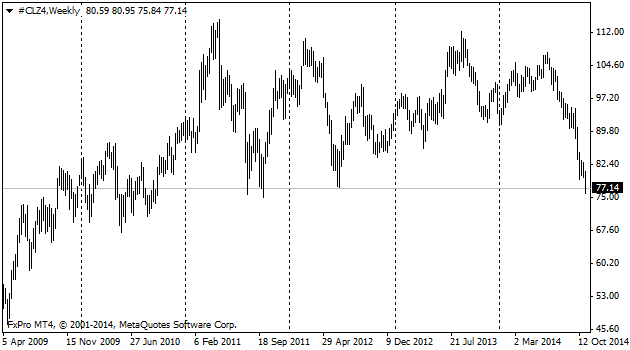

oil

The Saudi Arabia keeps acting like a bear and has reduced Oil prices for the USA this week. Now WTI is trading at 76.50 and this is a level, which the rates bounced off in August and October 2011 and then in June 2012. But this time the situation can go farther. We shouldn't expect strong support at these levels and focus on the performance of Oil near the preceding consolidation range (70-80 dollars). Probably, we can hope to see a slowdown only close to 70. But it is provided OPEC's mood is not very sluggish.