EUR/usd

ECB Governor Mario draghi failed to meet the demands of market participants. They were displeased with absence of a clear guideline in the monetary policy easing. Formally, the Bank pointed out that the policy has too many indefinite variables, so the size of future bond purchases can't be forecasted with great certainty. However, the BOJ, for example, solved the problem in a different way: they set the target (2% of inflation in the medium term) and defined the way (doubling of money supply), also remembering about methods (purchasing plans which can change). Basing on Draghi's comments, the markets suppose that the balance of the Bank will be expanded by €0.65-1.0trln. Purchasing of collateral bonds will start in the second half of October and asset-backed securities will be purchased “in the fourth quarter”. In the meantime, the latter has already begun. Obviously the market now finds such measures very cautious and doesn't hurry to sell the single currency as the ECB hasn't drawn a bazooka yet. As a result, eurusd managed to pull back only to the levels of Tuesday and even didn't reach 1.2700. The demand for correction in USD was hardly satisfied in this modest pullback. Yet, the latter may have no continuation. The employment indicators, which usually help to predict the results of Friday's report, have been performing well recently. Thus, yesterday's statistics on unemployment claims indicated an unexpectedly sharp drop from 295K to 287K. Because of that the four-week MA fell down to the zone of the multiyear lows. It speaks about recovery of the violent dynamics, observed in the preceding months. Also it is worth mentioning that continuing claims are still in the downtrend. It already speaks about a relatively tighter labour market. Because of that and also in connection with other indicators, analysts and traders expect that today's payrolls will again show growth in employment above 200K in September and that the rates for August (growth by 142K) will be revised up, as is often the case in this month.

GBP/USD

The British currency keeps depreciating against the dollar. The Manufacturing PMI, published on Wednesday, cast so much gloom over the situation that even yesterday's growth of Construction PMI failed to inspire market players with optimism. Against the expected decline from 64.0 to 63.7 there was growth to 64.2 (very close to the January multiyear high of 64.6), but yet the cable fell down. It keeps falling today, though already for a more sound reason – decrease in Services PMI from 60.5 to 58.7 and as a consequence serious slowdown of Composite PMI. This situation again arouses doubts if the BOE will raise the rate earlier than the Fed.

USD/JPY

The level of 108.00 proved to be too tough for bears. The pair bounced off this rate, though before that it had broken a couple of supports of the uptrends. Now the main threat to growth is posed by the unexpectedly poor statistics on the US employment. But it is sooner risks than a real scenario.

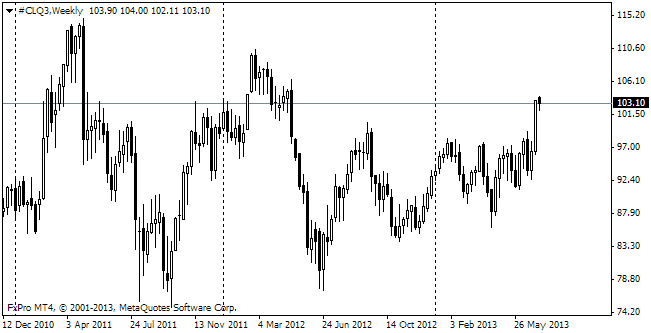

oil

Yesterday oil managed to pull itself together and get off the lows of April 2013. It seems that as before the main trading range of this instrument (the nearest WTI contract) lies between 90 and 110.