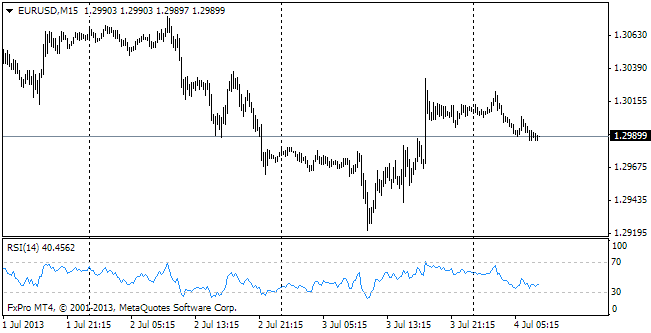

EUR/usd

Merkel's party has won the highest number of votes since the day of Germany's reunification, but it doesn't really mean that the Christian Democrats won't have to form a coalition. 42% of the votes secure 296 out of 598 seats at Bundestag. It implies that Germans generally like austerity and the prosperity that the country, which went out of recession long ago, has reached. The hopes that the tough austerity stance would be shaken by the social-democratic party with its left-wing views, haven't been realized. Now Greece, Portugal and Ireland may start fearing that such support of Merkel will entail requirement of tougher austerity from the ‘southern sufferers'. And hardly anyone doubts that these requirements will be imposed. It's been noted that before the election acute issues were hushed up as they mainly concerned external relations, unlike the situation before the election in the USA about a year ago, where the most difficult problems were connected with the domestic policy. The fact, that Germany managed to do without a sharp change of the policy, let eurusd open the week with an upward gap at 1.3547, which is by 25 pips above Friday's close. However, before that the market got too high, so that upsurge was regarded by big players as an opportunity to sell the pair at a lower rate. By now trading continues within a very narrow channel of 1.3500-1.3560, where it got on Thursday. This consolidation can be resolved only in one way – a sharp burst of volatility, which will lead the market in one or the other direction. And now, as seen from higher activity of rating agencies, it's time to have an eye on the troubled countries of the eurozone. In general, first we should expect problems from Europe and then the focus will again be switched to the USA with its debt ceiling.

GBP/USD

The pair has already recouped 3 fourths of the growth since the time the Fed's decision was announced. Here we can refer to the disappointment with the domestic stats, where retail sales failed to meet the forecasts. But it is also important to understand that the market will need to reshuffle positions, fixing profits after the growth by 5 figures since the beginning of September. Before that, in July and August, the upward movement was followed by a retracement, which crossed out about 50% of the gains. Probably, we'll see something like that in the remaining part of this month.

USD/JPY

The yen still can't venture to retest the level of 100¥ per dollar. We keep sticking to the opinion that growth won't start till the middle of October. At this time a year ago the yen went rallying and stopped only in May. If the yen grows above 100 right now, the annual growth of the rate will exceed 25%, which apparently doesn't correspond to the conditions of market stability.

AUD/USD

The aussie has felt a relief this morning, going up on the news about growth of Chinese Flash Manufacturing PMI by HSBC. According to the preliminary estimate, it has consolidated its positions in the growth zone, which should positively affect the affairs of Australian metal and coal mining companies. Despite all the efforts of the government of down under to go off the resource-based economy, the news about better activity in China still affect the Aussie much stronger than the domestic economic stats.