The pair, probably, laid to the floor. Yesterday EURUSD stabilized around 1.1260 level, and it continues to trade there today. Hesitations of market participants can be explained: they do not have ideas for the further trend development or drastic break of growth to the decline side. Meanwhile, nobody wants to run into the future since the weekend will bring too many official multinational meetings. IMF will report in Washington its vision of world economy (Analytical chapters of the report were published a week ago). As well we can wait for the cooperative announcements from g20 that will meet during Summit. Moreover, in Doha (Qatar) opec and non-OPEC members will meet, which either requires coordinate decision of the current issues. Extent of intention to make the common steps may seriously influence way of trading on the markets. So, G20 in February obviously affected the dollar weakening and supported recovering of the markets when they threatened Japan showing the importance of escaping of competitive devaluations. We should not wait for something opposite this time, but the announcements tone may be corrected after significant strengthening of yen and euro last time. The market attention is so much focused on the coming meetings of higher officials that inexpressive inflation data from the USA were actually ignored but they could seriously spoil dollar movement in other times. Annual inflation slowed down to 0.9% though they expected growth by 1.1%. Core inflation slightly corrected its growth and slowed down from 2.3% to 2.3%. This statistics was opposed by record low unemployment claims that reflects the strength of the labor market.

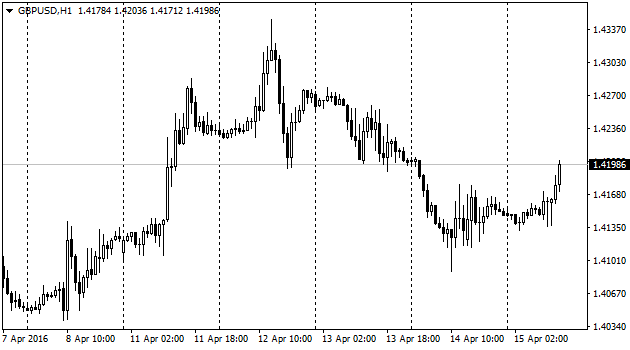

Yesterday, after the visible weakening in the first part of the week, British pound took a pause, the same as Euro did. Today GBPUSD is trying to return back higher than 1.42. Committee of Monetary Policy has warned that high level of uncertainty caused by Referendum may negatively effect economy growth of the country during the first 6 months. At the same time they said in the Bank that sterling weakening and oil prices rebound are able to support inflation. For the shorter perspective, meanwhile, inflation trend may not be that much impressing – it may slowdown in April due to seasonal factors.

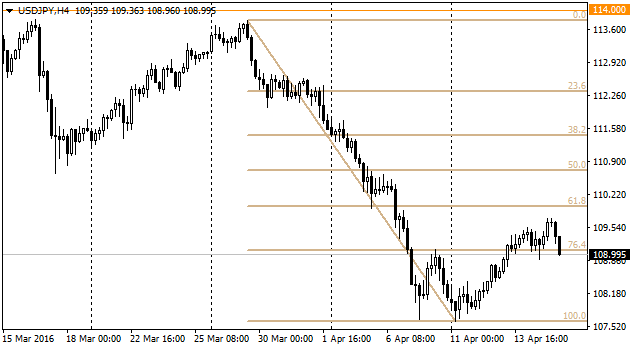

USDJPY

On Thursday the pair has creeped to area 109.50 – 61.8% correction from April drop – and could not develop further attack. Somehow, we can blame for it Kuroda, who managed to see correction in a tiny rebound. It is hard to believe it now, however if USDJPY comes back to the further decline it may target levels around 105. Though, in the beginning of the year we hardly believed the pair may steadily stay lower than 120.

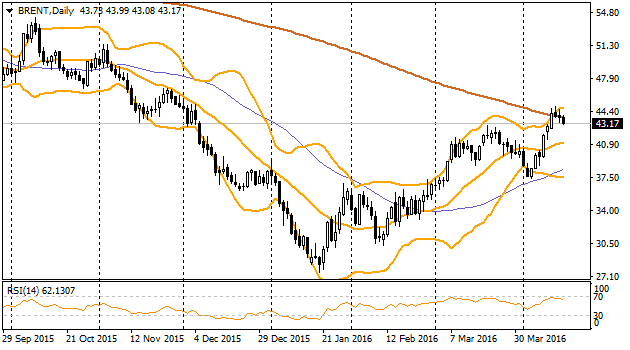

Coming weekend is going to be extremely important for oil. The most part of rally of this raw materials happening during last two months was based on expectations of Doha meeting. During all this time we were receiving quite contradictory information – starting from freezing levels of production from Russia and Saudi Arabia and till unwillingness if Iran to limit itself as well as the same response steps from Saudis. Meeting participants understand that even without real wish to limit themselves, they need to find the common decision. It is important to pay attention if they agree to make actual limitation, how long it will last and how big it will be. We have to remember that there is possibility that nothing will happen.