EUR/usd

The pair is drifting within a very narrow channel, still leaving the gap of the beginning of the week unclosed. Yesterday during the Asian session it fell down to 1.3324, which is the lowest point of the week for now. Anyway, the pair managed to move off these lows and returned to the middle of the trading range – closer to 1.3350. It's clearly seen that the market activity is dying down. More so, players for some reason don't pay attention to economic statistics. Thus, yesterday's economic sentiment for Germany and the eurozone proved to be better than forecasted – growth to 49.6 in Germany and to 58.6 in the euro zone. Note how much the regional indicator grew. Just three months ago Germany felt much better. For all the postcrisis period the indicator has been higher only once – in September 2009, when no one even talked about the sovereign debt crisis and hoped for the end of the crisis in the near future. Now the situation is none the less ambiguous. After the period of improvement ( especially noticeable for the periphery), the indicators apparently are going into correction. Such fluctuations are typical of the economy. The fact that the growth impulse is dying or have already died is clearly seen in the decline of the industrial production and also in the reduction of sales volume. Yesterday's data showed that the foreign trade surplus had stopped growing and had slightly decreased, but, what is more important, imports and exports are also on the decline. But it's all about the zone of the euro. In the USA the major indicators are growing, albeit with clear signs of the damping impulse lately. In our opinion, under such conditions (inflation slowdown, below-the trend growth rate and inexplicable progress in production) reduction in the bond-purchasing programme will be too hasty. Many assume that the Fed may decide in favour of a slight revision in order to render the message to the markets. However, the message is clearly understood by investors, who have been actively withdrawing their money from the developing markets in the recent months. So it is not very clear how today's meeting will end, in this connection we'd strongly recommend short-term traders to abstain from trading before the news.

GBP/USD

There is a feeling that the sterling has hit a support below 1.5900. This feeling can be deceptive in such a thin market. Just like in case with Europe, traders are ignoring the incoming statistics. Yesterday's data on inflation didn't produce any significant impact on the course of trading. The annual rate of the core consumer inflation remained unchanged at 2.0%, though it had been expected to demonstrate some acceleration. Against the forecasts of growth, Producer Price Index Input have dropped, Producer Price Index Output haven't grown either. Today there will be a release of the September meeting minutes, yet the market will hardly go out of the waiting mode on the threshold of the Fed's decision.

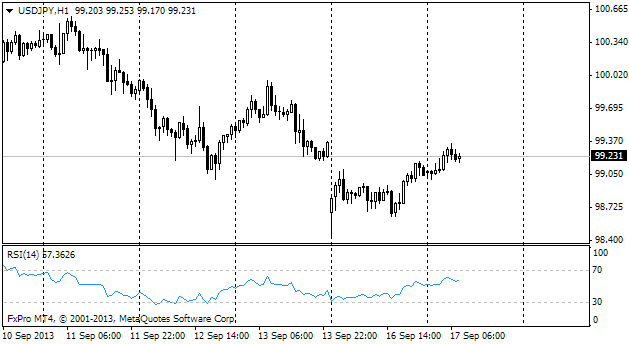

USD/JPY

Even the yen has stalled, standing still at 99.20. Over the last 24 hours there have been many attempts to rise, but they all have stumbled over the considerable offer, which have taken trading back to the usual levels. Powers of bears and bulls are now balanced.

gold

September wasn't a very lucky month for Gold as expected. At least now the metal is pressed by expectations of the stimulus rollback in the USA, which entails increase in interest rates on the debt instruments. This makes investments in Gold less attractive. However, we shouldn't forget that in the second half-year demand for the precious metal often grows, so buying below 1300 ( now the rates are at 1301) may bring profits already this year.