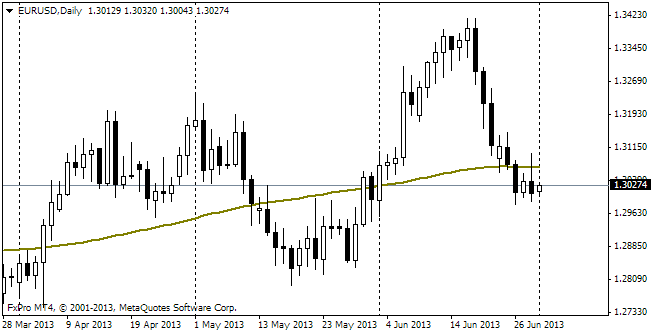

EUR/usd

Are you surprised? If you a regular reader of our reviews, then scarcely. At the September meeting of the fomc it was decided to change nothing in the policy of the Fed. The US dollar fell against the single currency by more than two figures. Partly it happened due to the local highs being close (1.34) – breaking through them gave rise to the across-the-board selling of USD. As a result, the movement stopped only at 1.3520, where the pair keeps consolidating now. Besides the traditional list of estimates of economic indicators the commentary to the decision also mentions that the stimulus rollback may hamper the economy, which doesn't look very strong yet. Well, it is quite a logical conclusion, taking into account the economic data of the recent weeks. Anyway, the fact, that at the last press-conference in June Bernanke started speaking about easing and hasn't done that in September, has surely left many disappointed. The thing is that, speaking about the possibility to reduce incentives, Bernanke took into consideration macroeconomic indicators, coming out at the time, but the positive they rendered turned out to be short-term. However, even a single allusion to the possibility of the stimulus rollback was enough to provoke tectonic shifts in most of the markets. Thus, the developing markets faced considerable capital outflow, demanding Brazil's and Turkey's governments to increase the rates to make their currencies more attractive. India didn't venture to do that and, as a result, encountered the drop of the rupee against the dollar to the historic low. The Chinese economy, spurred by the outward investments, lost that support and demonstrated almost the same size of investments in July as in the same month a year ago. What will happen next? In our opinion, there will be an attempt to reach the yearly highs, that is above 1.37, which is not guaranteed to be a success. Now all attention should be switched to the euro zone with its ongoing sovereign debt crisis and probable damping of the economic impulse.

GBP/USD

The pound was somewhat lagging behind the euro in its uprise against USD, however the latter can't but be called impressive as well. Besides, the sterling has been rallying since the beginning of September, so the remaining number of bulls at the market is now not enough to ensure the traditionally stronger growth of the pound in comparison with the euro. With these factors considered, the cable's results are on the whole similar to these of the euro: the pound has returned to the levels of the beginning of the year (January's highs), being about 2 figures away from the yearly highs.

USD/JPY

The yen-traders had a tougher time. On the one hand, the dollar's decline should provoke selling of the yen against the US currency, but on the other hand the positive movement in the stock exchanges is very often supported by weakening of the funded Japanese currency. On balance there is a short-term drop to 97.70, which has attracted yen-sellers. Since the beginning of the active Asian session, the pair has been gradually growing, as well due to the better-than-expected foreign trade statistics.

NZD/USD

The Kiwi proved to be one of the winners of the rally against the dollar. The final jerk it made with the help of the GDP stats. Due to the revision of the previous data the annual economic growth turned out to be stronger than expected, making 2.5% against the forecasted 2.3%. Of course, it is not quite the reason to justify all the preceding 10% growth, but is it important now?