EUR/usd

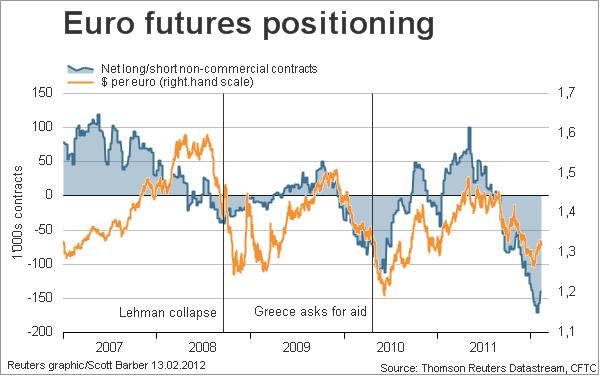

The Greek parties adopted a package of fiscal austerity. 199 out of 300 deputies voted for the adoption of the package. 43 voted against and thereafter were expelled from their parties. The voting was held against the background of fierce riots in the streets of Athens and other large cities. However, all that along with the approaching elections did not prevent the austerity adoption which is to be followed by the allocation of money from the EU/IMF. The news in itself is good; the euro bounced up to 1.3260 during the Asian session, thus having almost made up for the decline on Friday afternoon. It's interesting that the positioning against the euro should be, though less aggressive, but still close to the historic lows. This means that the euro in the coming weeks will have more room to move up than down. Judging by the charts, the euro has the potential to rise above 1.42 next month. At the same time the stock markets remain overbought. And it would be really interesting to know which of the market forces will prove stronger in the near future. The American S&P holds in the area of highs, from where it was falling in May and July last year. It is quite probable that for the next couple of weeks the purchases of risky assets will be still dominating the market on the strong data from the United States and the improved situation on the European interbank market. At the end of this week the ECB will hold the second LTRO auction.

GBP/USD

Following the euro, the British pound has been rising since the start of trading in Asia on the recovery of demand for risky assets and the dollar retreat. Last week the pair began the correction of the previous rally and fell from 1.5930 to 1.5730 on Friday afternoon. However, with the positive mood prevailing in the markets, we will probably see another test of this important level, as the 200-day moving average is passing through it at the moment. Bulls bet that if this level is broken, they will be joined by institutional investors, and that may drive the sterling much higher. Just like the euro, the pound/dollar also has space to grow.

USD/JPY

The getting stronger USD / JPY rally was held up at 77.80 on Friday. This is the maximum closing level of January and also the area of December trading. The Japanese economy is still expected to decline due to the reduction of the trade surplus. The GDP figures published today show the decrease of 2.3% q/q on annualized rate. Considering this, it would be really surprising to see the national currency strengthening in the long run.

AUD/USD

The aussie is now gradually recovering from Friday's sales, though the complete compensation of its lost positions is still long to reach. The sales were spurred by the quarterly commentary on the monetary policy, which hinted at the possibility of further rate cuts. It should be noted that at the moment the Aussie looks weaker than the New Zealand dollar, which for now has already made up for Friday's decline on the market correction.