EUR/usd

The US dollar has closed the second week with decrease. The dollar index is again flirting with the rate of 80, which hasn't been seen for over a month. The main reason for such pressure is poor consumer demand. Apart from Wednesday's downward revision of the final GDP data for the first quarter, yesterday we got consumer spending statistics for May. This is a wider indicator than retail sales, the Fed often appeals to it when considering consumer activity. So, yesterday's data proved to fall short of expectations. The personal spending last month grew by 0.2% (against the expected by 0.4%). The consumer spending also failed to meet the expectations, growing just by 0.4% instead of the forecasted 0.5%. It's important that the spending statistics for the previous months have been revised down, thus pointing out caution with which Americans spend despite rapid employment growth. Eventually, it is spilling over into the slight, but still conspicuous increase in savings over the recent months. It will hardly become a trend against the background of strengthening consumer inflation. It's interesting to see the Fed's attitude to the new information as the slowdown of consumer activity coincided with the beginning of tapering. Besides, the contraction of the economy in the first quarter, though presenting a retrospective view, can scarcely be ignored, since it is the biggest one among all periods of economic growth since WWII. Under such conditions it is more and more difficult to remain a dollar bull. Despite the initial selling in the pair yesterday, which brought the euro/dollar to 1.3575, there were enough buyers to take the euro back above 1.3600. The attack is still in progress, a series of ascending highs and lows looks more and more clearly.

GBP/USD

The British pound is again above 1.70. The limits imposed on new mortgage loans proved to be not very tough. There is a plan to limit 15% of all new mortgage lending (per bank) to 4.5 times income. Now with no limits attached it makes 20%. The insignificant nature of limits presupposes that there won't be any grand changes in the real estate market and therefore there won't be any considerable impact on the date of the first potential rate increase by the BOE.

USD/JPY

The pair broke through its 200-day MA. The bears are rejoicing, intensifying pressure. Already now trading is held at the support of 101.20. This level has been a good lower bound since last February, but then the bears didn't have the 200-day MA behind them.

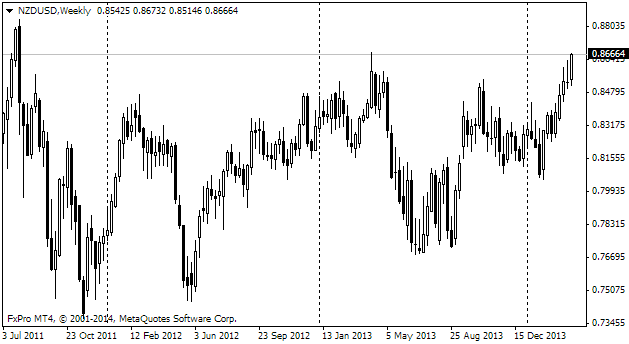

NZD/USD

This week the New Zealand dollar has returned to the area of multi-year highs against USD. Over this week the pair has grown by about 4 figures or 4.7%. Today in the course of trading in Wellington the pair hit a fresh high since the beginning of May. Above it the pair was only in August 2011 for just a few hours.