EURUSD

Last week the federal reserve members performed active campaign for changing of market expectations about interest rates. Fed Reserve representatives referred that market volatility calmed down in comparison with the situation in the beginning of the year, while more economic indicators came to the normal levels. Moreover, April FOMC minutes have reflected either that the Committee is seriously considering the rates increase in June. We would like to mention that previous data, possessed by the Committee, were much worse than those noticed during last weeks. Simultaneously, Federal Reserve is observing foreign financial markets cautiously watching out for volatility.

They do not say it directly in the Fed Reserve, but the Committee is considering the possibility to run supporting action and not to raise the rate in June since the Committee meeting is set up for the date before brexit referendum. Even July rate increase is much closer than the market expects, predicting no raise at all in the current year. The beginning of the work for shifting market expectations is supporting American currency to gain against main competitors during the third week.

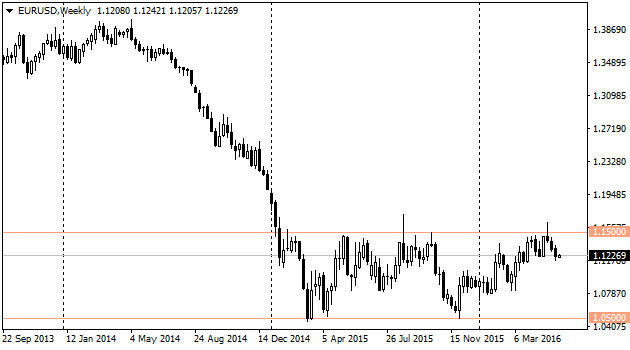

However, it is important to mention another fact. During three weeks of declining EURUSD was able to compensate one week of rising at the end of April. Currently euro costs 1.1230 usd, having returned to the range formed in February 2015. The short-term exit out of the range in the very end of April today looks like exposure of short positions made to shake out “unnecessary” players out of market by means of short coverage. EURUSD downtrend may continue this week, especially if FRS officials move on their intention of policy tightening.

The medium-term movement in the range makes it possible to predict potential decline to 1.05 area. The pair moved twice totally from the upper to the lower boundary of the channel. The first time it took 4 weeks, the second time – 8 weeks. For the further declining Federal Reserve needs to move on preparing markets actively. Either this may happens based on strong macroeconomic news from the USA or weak news from Europe.

There are no many important news from the USA this week. The second estimation of the GDP will be published on Friday. From Europe during the first part of the week we will have PMI releases. Last months they did not influence markets strongly, but in terms of lack of macroeconomic data, they may cause the movement direction.

GBPUSD

The previous week British currency started with the quite sharp growth due to announcement about increase in the share of population that would vote for UK staying in the EU. As the same time cautious officials forced to correct their own policy and postpone important decisions (like Federal Reserve) due to Brexit risks. Those markets that can act here and now are buying the British pound. Though, its growth potential is limited by strengthening of the USD which caused GPBUSD rebound from the rise of the beginning of the week, so the pair remained eventually below 1.45 level. However, due to the shifts in Brexit survey results along with the quite optimistic indicators of prices and consumer spending, the chances for the pair return lower 1.40 in the nearest perspective have considerably diminished.

Yen was following the trend of dollar strengthening, allowing USDJPY to grow the third week in a row and break 110 level that did not happened since the end of April. The downtrend channel was formed for the week until May, 27: with the lower boundary level around 111 and the upper boundary level a bit higher 113. This week Japan will either release not much news, main of them are concentrated on Friday. Then the consumer inflation will be released. It is important to pay attention to the latest since it is going to be the last data before the next Bank of Japan meeting. Currently markets hope that the coming indicators will be definitely bad and that will help the Bank of Japan to stimulate easing.

USDCAD

The Canadian currency continues its correction based on oil decline as well as caused by the American currency strengthening. Currently the pair traded around 1.31 level. The full correction may assume as moving to 1.33 area. The move higher will cause us to talk about stronger positions of USD bulls and potential for deeper correction. Meanwhile, the tendency of the canadian dollar cannot rely on internal data. This data is relatively not bad, so the main driver of the correction can be oil. If it can turn to the uptrend, loonie correction will disappear at once.