EUR/usd

Obama called Russia a regional power, threatening its neighbours. This statement was treated by the markets as quite tough and promising stronger tension in the region, which eventually caused selling of risky assets at the end of the NY session. The chain-reaction spread further to the markets of the Asian-Pacific region. It contributed to strengthening of the euro and franc, but almost didn't affect the euro/dollar. The pair has been enjoying support on decline below 1.3800 since the beginning of the week. The press more and more often mentions ECB's readiness to ease the policy if the situation gets worse. It's hard to argue with this, but it should be taken into account that the EU economy is growing quite well. To be more exact, its growth pace would hardly be enough for the USA and Britain, but for Europe it is quite a significant acceleration, making ECB officials feel self-confident and neglect considering incentives. Thus, despite the fact that we find the single currency expensive, there are no reasons to expect a rate cut this week. For the CB to enter the territory of negative interest rates, there should be something more than decline of the economic sentiment indexes from the multi-year highs down to more neutral levels. Once again we come to the conclusion that decrease in eurusd will be caused only by growth of the US currency. It may happen today in case of stronger activity in the real estate sector (the expected growth rate is just 0.2% m/m) and if the US Final GDP will be revised by more than expected. Now it is supposed that the final estimate will be raised to 2.7% y/y instead of 2.4%, calculated a month ago. Technically, behaviour of the pair at 1.3760 is of importance. Should it be broken down with confidence, selling may get more intense.

GBP/USD

Martin Wale, a member of the BOE's MPC, said yesterday that the Bank would eventually raise the rates to the normal levels while the economic growth was getting faster. This banal phrase was treated by the markets as a hint at the near rate increase in Britain. Yesterday the British currency was eagerly purchased not only against the euro, but also against the dollars. The pound, which had been suffering since the beginning of the month, grew strong enough to bounce and move confidently above 1.65. Now trading is held at 1.6570 and the main risk is posed by the release of retail sales statistics. Anyway, we keep regarding the movement to 1.6700 as an opportunity to sell the pair at a higher price.

USD/JPY

Selling in the US markets aroused demand for the safe yen. The market participants are again ignoring readiness of the BOJ to further ease the policy. Investors' attention is focused on tax increases in April, which are threatening to slow down the economic growth in the country. However, the actual data on the economic slowdown will be received only in a few months and only then it will be possible to consider urgency of new incentives. It means that probably we shouldn't wait for the yen to renew the trend for internal reasons.

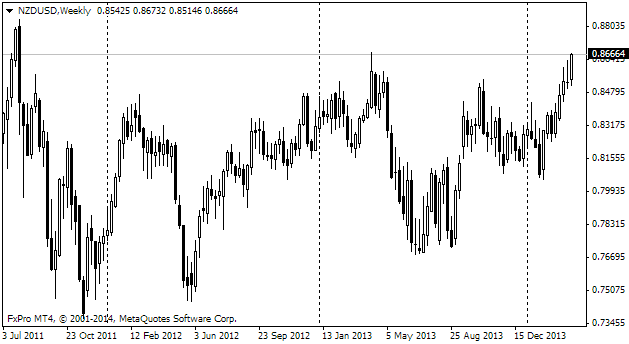

NZD/USD

The Kiwi has gathered stops and is now attacking new highs. Last year's high, which held for a few hours then, made 0.8675, while the current intraday high is 0.8673. The further possible target of the attack is the peak of 2011, which makes 0.8841. Today's rally is triggered by the excellent trade balance report, which reflected recovery of exports and decline of imports.