EUR/usd

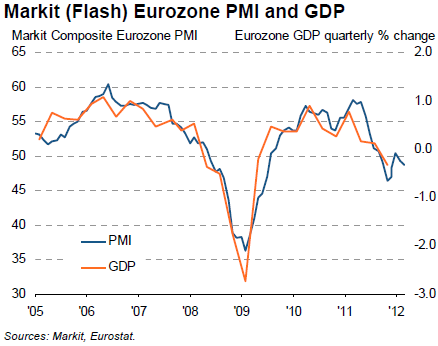

The European PMI data caused quite a stir yesterday. Prior to their release markets had been cheered up by the more or less stabilizing situation in Greece and decrease in spreads of peripheral bonds to the corresponding bonds of the core countries. However, yesterday's PMI figures proved to be really alarming and triggered sales of the single currency, which eventually fell down to 1.3130. Yesterday we mentioned that PMI is a good GDP indicator. To show it more vividly Markit publishes the PMI and GDP graphs. According to them the eurozone is likely to slide into recession in the first quarter. This goes in contrast with what has been promised by German indicators. But don't forget that Germany is just a part of the euro area. As a result of tough austerity measures the periphery keeps suffering a severe economic downturn. So, even Germany cannot escape this lot, because most of its production is targeted at the export to other European countries. The US, on the contrary, enjoys a batch of quite positive news. The number of initial claims for unemployment insurance benefits continues to go down. At the same time, the total number of those who are currently entitled for the benefits is decreasing as well. According to most recent data, last week the number of initial claims fell to 348K, the figure we haven't seen since the beginning of 2008. Nevertheless, we still consider that Europe keeps following the path of recovery, though perhaps not as quickly as wanted. Liquidity provided by the ECB has done its part in smoothing over the effects of the sovereign debt crisis. The single currency may quickly recover from yesterday's sales and rush to new local highs in the coming days.

GBP/USD

Yesterday the British pound fell innocent victim to the euro decline. While the single currency managed to recover and recoup its losses by the end of the day, the pound closed out the day negative, just above 1.58. The graph clearly shows that traders are struggling for the 200-day moving average level. We cannot observe any definite trend in the EUR/GBP pair. Next week data on the country's current account balance for the 4th quarter and also on final GDP are scheduled to be released. There is a suspicion that market participants won't take any particular steps and therefore won't set any definite trend before that time.

USD/JPY

The Japanese yen quite unexpectedly assumed the offensive yesterday. The across-the-board sales, boosted by the weak PMI data, received more support in Asia on the growing concerns about China's hard landing. The USD/JPY has slipped from the 84 level to below 83 in two days. A similar decline has been also observed in the yen crosses. Nevertheless, we believe that it can be mainly attributed to profit-taking in the stock markets. Thus, correction may unfold already next week or even today as a result of quiet trading.

AUD/USD

The aussie is still one of the market losers. During the Great Recession Australia suffered downturn only for a quarter thanks to strong growth in China. But now mere fears about slowdown in China's growth and industrial weakness of the country generate surprisingly serious suspicions that in the coming months the RBA will have to cut its interest rate to make up for the economic weakness and decline in exports. Still now the AUD/USD looks very attractive for short-term buying from the 1.04 level.