EUR/usd

The European finance ministers refused the offer of Greek private debt holders. The country wouldn't agree to the coupon payment of more than 3.5% while the Institute of International Finance set the minimum coupon level at 4%. The EU and the IMF take up the part of Greece, so the latter looks stronger. The essence of the problem is that the suffering European economies are likely to be in a dejected condition for many years to come. Greece's GDP has been declining for five years in a row and will keep falling further, as debt payment makes the country to tighten its belt too much. The same can be said about Spain. The unemployment rate is really high there and that inflates the budget deficit. Cost-saving measures that have to be constantly toughened also aggravate the situation giving employment no way to grow. The Spanish have been suffering for a long time and it seems to have drained them of all their strength. Finance Minister calls for mercy, that is, to adjust the deficit targets. Mario Monti and Mario draghi also point out the necessity of urging “rich” countries to provide more support to troubled countries. But why should Germans pay for Italy? The answer is because they are richer. That is how it happens in our world – the rich should help the poor. It would be more immoral to force poor Slovenia or India to come to Italy's rescue (through increased contributions to the IMF). The euro has risen to 1.30 technically. I wonder if the single currency will be able to rise to 1.32. If it did, it would confirm the trend for further growth, but at the same time would tell badly on the positions of exporters from poor countries. Following the collapse of the euro since early November, the consumer and producer sentiments have just begun to turn upward. The rise of the euro in current circumstances is sure to push the eurozone into a deeper recession than it could be.

GBP/USD

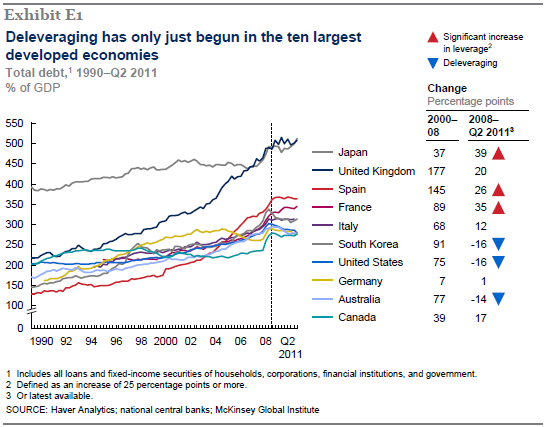

Britain is now often said to approach the debt crisis. Indeed, McKinsey's recent research with respect to debt load and deleveraging makes the seriousness of the country's debt problems very clear. However, a significant part of the debt belongs to households, paying the mortgage. But in contrast to the U.S. in Britain the right of redemption cannot be taken away that easily. For this reason, the country remains frozen, having survived two and a half years of constant credit cuts. Banks don't lend to households and businesses. They tend to buy governmental bonds of the highest rating and build up their reserves to meet tougher regulatory requirements and insure themselves against losses from external and domestic loans. The Bank of England may absorb the latter, continuing to buy gilts and making them less profitable. But the serious budget deficit in the country maintains a dire need in borrowing. The latest data on this indicator will be published today at the beginning of London session. The speculations on the BoE's probable extension of the QE program weaken the pound, but it can't be any other way under current circumstances. Now the sterling is trading at 1.5445, after failing to break above 1.56.

USD/JPY

The recent meeting of the bank of japan didn't bring any surprises. The rate and terms were left the same, and then followed Shirakawa's traditional pledges to monitor the international uncertainty and to get ready for further softening of monetary conditions. In addition, the Bank lowered its growth estimate for 2011 from +0.3% to -0.4%, slightly reduced it for 2012 (from 2.2% to 2.0%) and minimally increased it for 2013 (from 1.5% to 1.6%). Yet the presentation of the government forces to ponder over the country's prospects. The Cabinet Office pointed out that even doubled sales taxes, PM is about to impose, won't save the country from the deficit. The yen still holds higher than 77.0 on the positive sentiment in the stock markets. However, it should be taken into account that the monetary policy in the country will remain super-soft for a long time, thus telling negatively on the yen.

AUD/USD

The aussie bulls achieved their goal during yesterday's auctions. They drove the pair to 1.0570, after which it again drifted back and is now trading at 1.0490. The Aussie bulls really need some rest. They've done a great job, having pushed AUD from below parity to the current levels despite the slowdown of the domestic and Chinese economies. It's quite likely that the RBA will lower the country's rate next week, which implies that the near-term prospects of the Aussie are swinging between consolidation and falling.