EUR/usd

The market was rather anemic yesterday: there weren't any vital economic releases and some local markets were closed. The Forex market performed in the corresponding way. Having started the day with recouping of Friday's optimism (max 1.2443), the single currency dropped down at the heated EU session (min 1.2341). However, by the end of trading the pair returned right to the opening levels, i.e. 1.24. Tuesday promises to be an eventful day. Looking at the EU statistics, Factory Orders are worth considering. The release will bring data for June, when the single currency was steadily trading below 1.30. On the one hand, it must have made German production more competitive. But on the other hand, it was the time when investors were especially concerned about the future of the euro, so many preferred to sit on the sidelines of the currency. Moreover, as we know the business sentiment was not at its best at the time, so this can be also reflected in today's statistics. Will the fresh interest in the single currency be stronger than the negative brought by fundamental indicators? Or will the statistics prove to be not bad at all? This way or another, with the current disposition of the market, the euro will be purchased on the positive, taking no notice of the negative. Just before the release of German factory orders the Italian statistical office will announce the GDP outlook for the second quarter. The markets expect that the economy will go down by 0.7% after the decline by 0.8% in the first quarter and by 0.7% in the fourth quarter. At the beginning of the previous week Mario Monti asserted that the crisis was heading for its end. Is it really so, we wonder? The ECB did its job, cooling the ardour of debt markets. However, once again we are likely to observe some discord among local politicians. More and more German officials are showing their dissatisfaction with draghi's plan and want to punish Monti's impudence. Spaniards and Italians are greater in number, but Germany is more powerful and has the right of veto in many issues. Technically, the euro is quite cheap now, so it's very likely that the currency will appreciate in value, targeting 1.30 or a bit higher.

GBP/USD

The British pound performs worse than most other currencies. Yesterday the sterling weakened largely due to the poor housing statistics. Halifax House Price Index dropped by 0.6% in July. The same decline was observed a year ago. Yet, the BRC Retail Sales Monitor has grown by 0.1% annually. It's better than expected (-0.2%), but much worse than a month ago (1.4%). Today in a few hours after the release of industrial production statistics NIESR will publish its GDP estimate for the three months to July. Last week this research institute forecasted that the British GDP would decrease by 0.5% annually. This means that in the third and fourth quarters the economy will be growing, albeit rather sluggishly, as since the beginning of the year the economy has already shrunk by almost a percent (-0.3% in 1Q and -0.7% in 2Q).

AUD/USD

As expected by markets, the Australian CB kept the official interest rate unchanged at 3.5%. When giving a commentary to the bank's decision, Glenn Stevens pointed out the decline of short-term interest rates faced by high-rated sovereigns (of course, including Australia) to tremendously low levels. But it was also mentioned that the Australian banks and corporations don't have any problems with demand for their bonds. In addition, due to the previous rate cuts the RBA notes easing in the financial markets, ‘a bit below average' interest rates for borrowers, the largest growth of business loans in the recent few years, though the general growth of the economy promises to be within the trend. Thus, the Bank hints that if there are no shocking turns of events somewhere outside (especially in Europe), further easing will be out of question.

USD/CHF

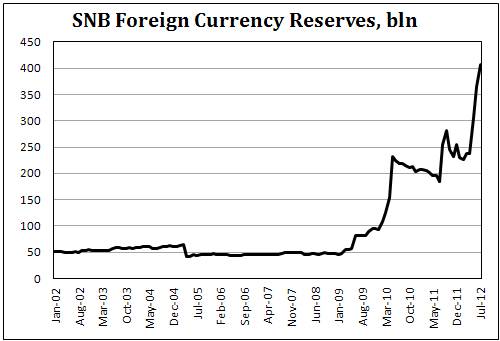

Though there's nothing particularly interesting about the Swiss currency, moving in tandem with the euro, the Swiss economy deserves attention due to the recent news releases. The unemployment has grown over the first half-year, showing a 1.5K increase in July. It is largely connected with the seasonal factors (this statistics are not seasonally adjusted). However, this summer has been rather ‘slack' in regard to unemployment reduction. Since the beginning of the year the figure has fallen by 14.4K, while in 2011 it dropped by 39.5K over the first seven months and in 2010 the decline was by 30.4K. Meanwhile the SNB keeps curbing the capital inflow, building up its cash reserves. In July they grew by 406.5bln. For reference, last February the reserves made 227bln. So, behind the seeming quietness of the rate there stand strenuous efforts of the CB to pump capital out of Europe. It will be surprising if the SNB isn't working out any other ways to affect the market at the moment.