EUR/usd

The brief disappointment with the poor French statistics and further enthusiasm aroused by the German and EU data made yesterday's European session quite volatile. After the release of the French data eurusd tumbled down to 1.38, but then within an hour it grew by half a figure. However, bulls failed to hold even this level. By the end of the day the pair still slipped down towards 1.3815. After 10 days of flat trading the single currency seems to react more nervously to the news, but yet has enough strength to return to its former levels. It is all about absence of certainty. Many wait to see a concrete plan of the monetary policy weakening, but the German opposition and favourable recovery indicators don't allow to start up stimulating measures. Many speak about the intention of EU officials to simply ‘talk down the currency', it means to carry out verbal interventions, which will send the euro down, and don't take any specific steps, which might have negative consequences. It is easier to change the rhetoric rather than launch tapering. The closer the meetings of the ECB (May 8) and of the Fed (April 30) are, the more attention is paid to what the CBs' high officials speak. But if with the Fed the situation is more or less clear (another cut by 10bln dollars), with the ECB it is not all that certain. At the press-conference in April draghi made it clear that the committee was surprised by such a sharp slowdown in inflation, and there was a feeling that in May some specific actions would be already taken. However, the further comments of other ECB members almost completely dispersed these expectations. Today the markets will again be much interested in Draghi's comments. The release of the Ifo business climate index will be of much significance too. It is quite reasonable to expect slight decline of the general indicator, from 110.7 to 110.5.

GBP/USD

The sterling failed to hold out at 1.68. Even the reduction of the budget deficit didn't help here. The public borrowing indicators proved to be better than expected and than the rates of this very month a year ago. Anyway, the cable needs more obvious signs of economic growth in Britain to justify purchases at such high levels. The statistics on industrial orders and selling prices, published later, contributed to maintaining of the cautious tone in regard to the currency.

NZD/USD

The Reserve Bank of New Zealand again has increased the rate (according to the expectations) and preserved the hawkish sentiment for the future despite the expectations of hints at a pause. It's been the second increase in the new cycle of toughening and led the general rate to 3.0%, whereas before March it had made 2.5%. The Kiwi has jumped up against USD and is now trading at 0.8620 against the low of the beginning of the week (0.8560), but yet there is still more than a figure to the preceding highs.

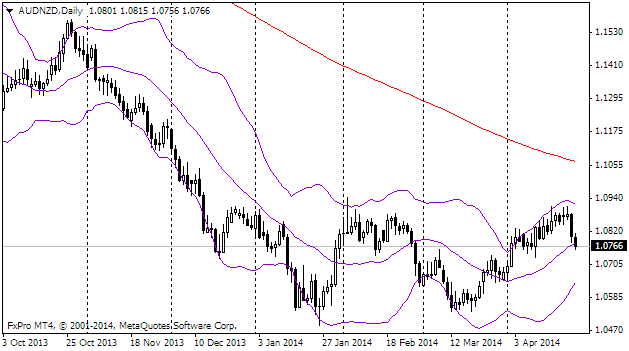

AUD/NZD

The story with the Kiwi's uprise only aggravates the difference with the Australian currency. After falling under pressure on the poor inflation statistics yesterday, audnzd has continued depreciating on the hawkish comments of the RBNZ today. Yet, in the grand scheme of things we favour the aussie as the strength of New Zealand depends on the high food prices, which have been significantly adjusted already. Thus, in the coming weeks there can arise a possibility of the long-term purchasing of the pair.