EUR/usd

Yesterday bears intensified their pressure on eurusd, pushing the pair down to the lowest levels since last November. Now trading is held close to 1.3460. Bulls simply didn't have enough strength to buy out EURUSD at 1.3520, so the strong selling impulse sent the pair down and now the latter doesn't hurry to rise from there. Softness of the ECB's monetary policy (the recent rate cuts and preparations for TLTRO) combined with the cyclic slowdown of the economy after quite a decent growth in the first quarter don't make the single currency the best candidate to grow. Besides, yesterday the USA released quite strong statistics. The inflation data generally met the expectations, having grown by 0.3% in June and by 2.1% over a year. The same rate of inflation was announced a month ago. The core inflation proved to be slightly weaker than expected, having risen only by 0.1% and slowed down its annual growth from 2.0% to 1.9%. Upon the whole we can hardly describe inflation as ‘suppressed'. Though it is too early to speak about the risk of growing inflation pressure, still being at the target level with the considerable growth of the labour market in the background, prices leave less and less space for the Fed's maneuver, being a powerful argument in favour of the earlier toughening of the policy. Another weighty argument is the housing market. Despite weakness of the data on housing starts and building permits, yesterday's stats on existing home sales surpassed the forecasts. The annual sales rate again above 5bln. (since last October). The winter dip is passed and forgotten. Today neither the USA nor Europe promise any interesting statistics, except, probably, the preliminary estimate of the EU consumer sentiment at the beginning of the US session. These data are expected to show minimum growth of the index, which will still remain negative.

GBP/USD

The British pound felt a bit better than the euro. Or rather bears had fewer chances there. There weren't any supports in the area, breaking through which could provoke an avalanche of triggering stop orders. In this connection the pound remained within the downtrend, coming off its lower bound – 1.7040. Now trading is already held at 1.7070 and against the euro the sterling is at the highest level since August 2012. Anyway, today the cable is running the risk to come under pressure, if the BOE's meeting minutes won't contain enough clear hints at the coming rate increase. Some expect at least one vote for the rate increase, though this is not consensus.

AUD/USD

The Aussie has been in demand for two days in a row. Yesterday it received support because the RBA's governor in his speech didn't express any concerns about the high currency rate and clear intention to cut the rate in the coming time. Today the currency was encouraged by the inflation statistics, which proved to be a bit stronger than expected. In the second quarter prices grew by 0.5% and the annual rate accelerated to 3.0%. A quarter before the rates were 0.6% and 2.9% respectively. Yet the Aussie is not far from the levels, which in Stevens' opinion are too high. It is very likely that AUD will face a serious resistance once it tries to come far off 0.94.

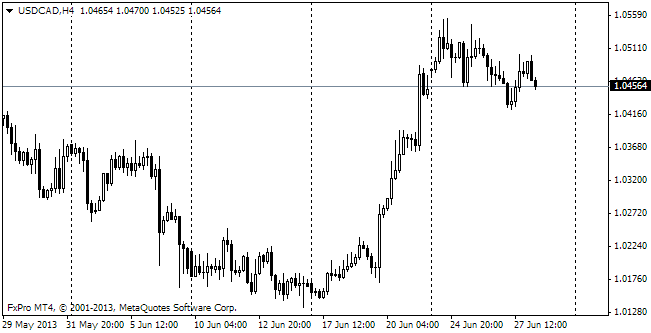

USD/CAD

The Canadian Loonie has been consolidating since the beginning of the previous week. The current sluggishness of the market can be broken by the domestic retail sales statistics. It is supposed that in May the sales grew by 0.6% after the impressive growth by 1.1% a month ago. In the meantime, even the expected monthly growth will hardly help to keep the annual rate of expansion as impressive as before. In April it made 5.1%. Here we see influence of a high base effect – in May 2014 the annual rate made 2.0%.