EUR/usd

The heaven tumbled down for the single currency yesterday. The sudden decline of the core interest rate and other accompanying rates by 10bp forced eurusd to fall down from the daily open of 1.3150 to 1.2940 by the end of the day. The pair was last seen that low more than a year ago. Then, in 2013, it found support near 1.2750, which leaves much space for maneuver regarding further decline. Though on the other hand EURUSD is so oversold that to stimulate depreciation today the US employment statistics should be unbelievably good. It is expected that the US employment will show growth by 222K of jobs in comparison with 209 a month ago and unemployment decrease to 6.1%. Actually, for the dollar to continue its ascent employment growth should make more than 250K. It is possible, but unlikely. Meanwhile, the downward deviation by 30-50K can provoke the beginning of correction against the dollar. The release of September's employment data can be also accompanied by a serious revision of the preceding values, so we should be ready for this as well. Also, we should beware unemployment growth due to increase in the participation rate. This rate has been low for the recent half century as people lost hope to find jobs and now some may try to join the workforce rows again to raise their income alongside opening of new vacancies. Thus, there are two possible scenarios today – decline to 1.2890/2900 or a pullback to 1.3050 or even closer to 1.31.

GBP/USD

The British pound was trying to react to the euro's depreciation for a while, as if it were not affected, but eventually fell victim to the dollar's rally. The cable dropped to 1.6280 during the Asian session today. The pound was that low for a short time in February and on steadier grounds – at the end of the previous year. In 2012 1.63 was a strong resistance, which prevented the cable from going higher many times. And now this very level can become an important support if dollar-traders are not able to assume the offensive. Today the British pound will be influenced by the US employment statistics, but before that there will be a release of Consumer Inflation expectations, which are also of interest. We shouldn't expect any other reaction but that to the US payrolls, but data on expected inflation can be a great help in choosing the further strategy with GBP.

USD/JPY

The Japanese yen keeps retreating before the resumption of the dollar's pressure. The slight correction in the middle of the week ended in hitting new highs. Last night the pair reached 105.70,thus hitting a fresh yearly high. The last time the pair was trading at the current levels was in September 2008. The cyclic high of that time is quite far away. The nearest important resistance is as far as 110.60. This level can be the end-of-year target, after which possibilities of continuation of the rally will be rather limited.

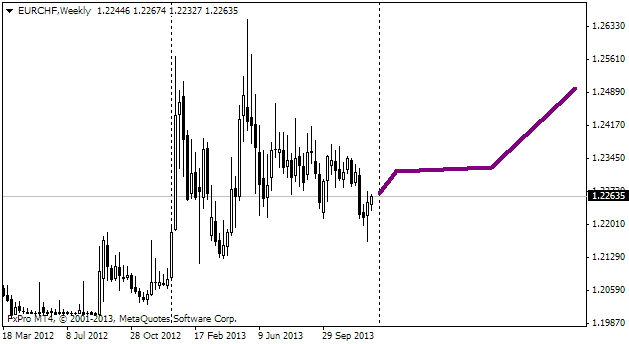

EUR/CHF

It seems that only the SNB and those who believe that the bank will defend 1.20 against the euro are purchasing EURCHF, which indirectly supports the euro against the dollar and other currencies. For now this support is quite moderate: the pair is consolidating close to 1.2060 in comparison with the lower point of 1.2043. Anyway, the current levels and the decline below 1.2050 looks as a good opportunity to buy the pair after the continuous growth. It doesn't looks as if the SNB was going to give up the idea to restrict the franc's growth as inflation in the country is fluctuating around the zero level annually and the economic growth looks quite sluggish (0.6% y/y).