EUR/usd

The US dollar keeps depreciating as demand for risky assets is growing. As before the risk demand spurs across-the-board depreciation of the dollar and renders great support to commodity prices. EURUSD managed to get above 1.3650, where from it slipped down at the end of January. Then the pair felt pressed due to expectations that the ECB would soften the monetary policy considering inflation easing. As it turned out, all in vain. The ECB doesn't seem to hurry with easing of the monetary policy, referring to improvement in the performance of the eurozone. Moreover, one of the main threats of the ECB, that is the bond-buying programme (OMT), was lifted last week by the German Court, which expressed its doubts about legitimacy of such operations and sent the decision to the European Court. Now in case of urgent need the ECB is likely to carry out only another round of LTRO, i.e. to issue loans at a refinancing rate in the volume digestible for the regional banks. In comparison with the first round, when such loans were issued at 1%, and the second one, when the rate made 0.75%, now the lending terms look much milder (0.25%). Also, it should be considered that last year the banks returned a part of the funds to the ECB and in general improved their balances and as such have an opportunity to undertake new obligations. And if we add here toughening of the US and British monetary policies, expected in about a year or a year and a half, the three-year LTRO loans ensure relatively ‘cheaper' money for the banks. But it is not certain yet if the ECB will take this measure. Unlike the USA, Europe prefers not to act till there's any acute need. Speaking about the impact of such measures on the euro, it is very little. On this realization the markets feel more eager to purchase the single currency. Today the rate has gone as high as 1.3670 and it is a serious claim for the further rally.

GBP/USD

The British pound is following the euro, appreciating against USD, albeit less intensely. Despite appreciation of the stock exchanges, which frequently supports the currency, now the pair is affected by the expectations of changes in the forward guidance. Instead of the initially expected 2.5 years it took the labour market half a year to get close to the threshold unemployment rate of 7% (the recent data showed 7.1%). Of course, even last summer it was mentioned that till the threshold was reached the question about the rate increase wouldn't be even considered, but still there are expectations that the BOE may set a different target, achieving of which may require more than a year.

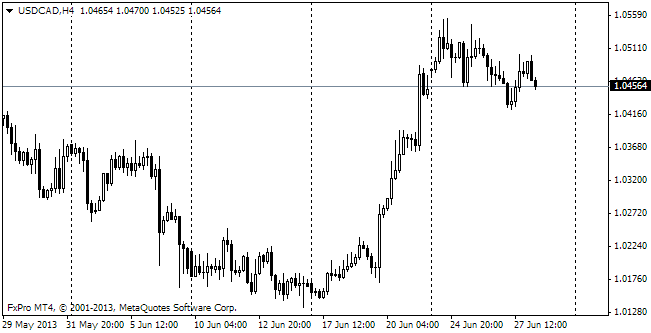

USD/CAD

The canadian dollar is now moving against the general cycle. While the US currency has been depreciating against its European rivals since last Wednesday and the aussie has been recouping its losses since the beginning of the month, the Canadian Loonie wasted all its gains on Friday after the release of strong employment statistics. It's remarkable that the correlation with gold, once strong, doesn't seem to hold good now. Gold is also growing and is now already at the highest levels for two months and a half. Purchasing of the pair now looks like a desire to stake on growth after the pullback. Here it will be important to watch the pair's behaviour close to 1.1120, the previous resistance of the consolidation.

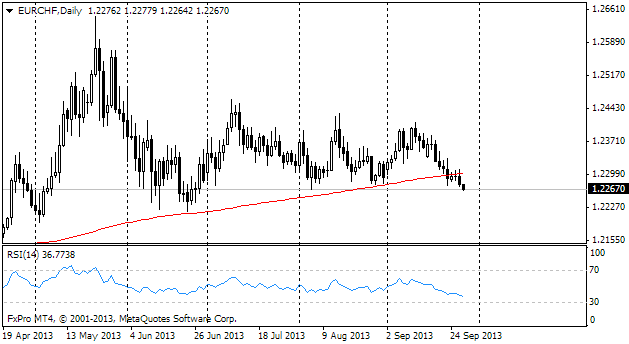

EUR/CHF

Just like in December the pair bears quite a good potential for growth as it pulled back to 1.2180. From these lows the euro has grown against the franc lately and trading is already held at 1.2230. As before we believe that at the current levels the growth potential makes not less than a figure.