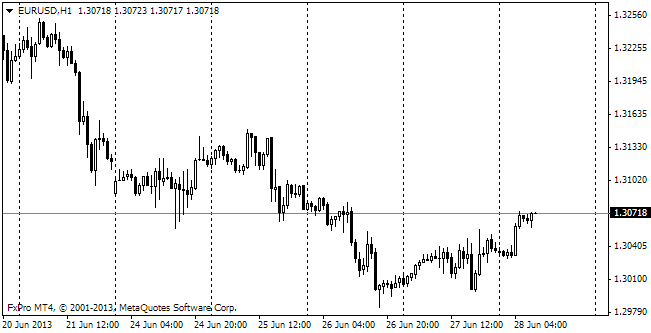

EUR/usd

Yesterday risk demand was getting stronger all through the day. It wasn't seen much in the performance of the euro/dollar, which was fluctuating between 1.3230 and 1.3275 and failed to go above the extremums of the previous day. It wasn't a big surprise, taking into account that there were no important macroeconomic stats released and the news that Obama had taken a less aggressive stance regarding Syria was already built in the rates. Anyway, today bulls tried to speed up the pair, hitting a new local high of 1.3281. Last week we mentioned that the period of strong macroeconomic data from the eurozone was probably coming to its end. Yesterday's release of the French industrial production statistics confirmed it. This publication is not of primary importance, but it can characterize the state of the eurozone much better than the similar data for Germany. So, instead of the expected growth by 0.7% production shrank by 0.6% in July. Manufacturing production decreased by 0.7%, while it had been expected to grow at the same rate. As a result, against last year's rates production in general fell by 1.8% and manufacturing production – by 2.5%. The Italian stats were not very reassuring – there was a certain revision of 2Q GDP from -0.2% down to -0.3%. With such indicators it's hard to believe that the single currency may remain strong for long as the economy has simply run out of growth drivers. In just the same way there remains a slight chance for improvement in the labour market and lending. Does it mean that the euro will start falling? Much to bears' distress, no. We see that the US economy is stumbling, which can be clearly observed in the labour market. We also shouldn't forget about the risks, which continue weighing upon the dollar. This is Syria threat, which in case of getting smaller will let the dollar fall, and also uncertainty with the public debt ceiling and adoption of the new budget, which may put significant pressure on the US currency.

GBP/USD

Unlike the single currency, the sterling managed to hit a fresh local high yesterday. The pair grew to 1.5740, going above the highs of August, though still having some space to reach the June levels. The bravura tone of the currency is supported by macroeconomic indicators, though the latter are not strong enough to affect the course of trading. First of all, yesterday it became known from RICS about growth of House Price Balance to 40%, which is the highest rate over 7 years. In addition, the employment forecast for the fourth quarter by Manpower remains high.

USD/JPY

Risk demand supported selling of the Japanese currency, which has fallen against the dollar to 100.60 this morning. Against the pound it is trading at 157.75. The pair hasn't been that high since 2009. EURJPY has been at the maximum rates since the beginning of 2010, however it was at such highs for a while last May.

AUD/USD

The aussie continued its attack yesterday. It's significant that the currency is moving up gradually, without any leaps. It can be a sign of strong demand, when players buy large volumes. Another bullish signal is that the pair managed to overcome the highs of July's consolidation. We stake on growth of the Aussie, expecting that the RBA won't cut the rate in the foreseeable future.