The pair touched yesterday 1.14, and some traders decided to fix their profits. However, today bulls again are trying to climb higher than that level. Such activity of the market players is rather unusual. More often before the USA employment data are released markets behave very quiet focusing on the upcoming news and lately blowing the chosen trend with the total strength. Nevertheless, last months have shown that employment data from the USA losing its big influence, not affecting huge bouncing on stock and Forex markets. The reasons of this are not in the underestimation of the data but in the stable figures of this indicator during last months. The companies are recruiting around 230 k employees monthly. This figure can be get as an average of last 3, 6 or 9 months. The average data for the last 12 month reaches 233 k what is caused by the failed March of 2015 (only 85k). Except of the steady data we can notice that traders, straight after federal reserve, are losing interest to the main indicator. The American Central Bank is paying more and more attention to the payrolls tendency. Acceleration of this indicator, though, will not be primary for trader but may still influence the market as we were monitoring during last months. Currently, the annual wages rate is 2.2%. This level is quite good given that February inflation rate reached 1.0%. Meanwhile, market analysts are trying to give their evaluation when wages growth is going to reflect the battle for the shrinking labour force. But in spite of the fact that unemployment has reached the level of “full employment”, below 5.0%, we still cannot indicate the above. The reason to be blamed is the drop of economically active population to almost 40-years lows. The crisis has uncovered too many citizens who decided to stop job searching and only in the second part of 2015 that trend started its turn. The growth of rate of economically active population combined with the unchanged inflation rate indicates the good sign for the economy, though may not affect immediately the stock quotes as if the inflation rate would fall in terms of the unchanged active population.

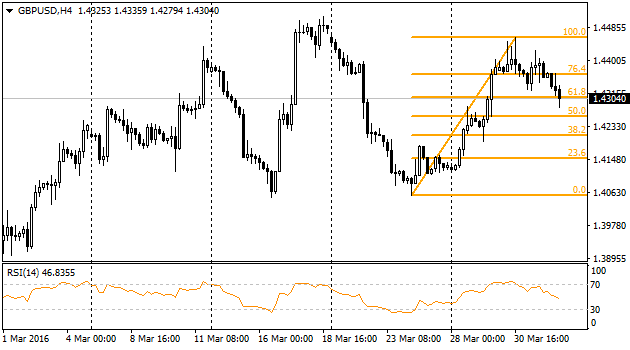

Unlike the common currency sterling is not feeling that well while losing the gains of the previous days. At the moment GBPUSD price has declined to 1.43. Obviously, bulls are giving up. Moreover, today bears are inspired by the relatively weak Manufacturing PMI. Its March release is showing 51.0 though analysts were expecting growth from 50.8 to 51.4. Short-term rally of pound since March 24 till March 30 has already turned back by 38.2% and, most probably, the negative trend will be force.

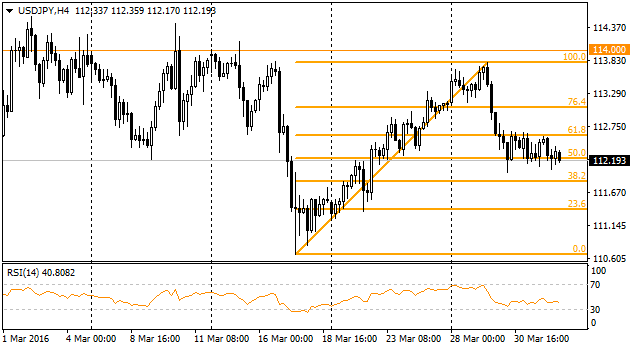

Japanese market received today a strong blow but the pair USDJPY reacted quite modest. Very weak results of quarterly Tankan report became the main driver of the Asian session. The activity index of the main producers dropped from 12 to 6, that is the 11 quarter low. Tankan Non-Manufacturing index as well decreased, though not that seriously, from 25 to 5, reflecting 5 quarter minimum.

Regardless of the rebound since second March decade the gold closed the quarter with the growth by 16%. This is the best quarter increase for the last 30 years. One third of such movement can be explained by weakening of usd index, the rest part – by the market fear and turn back of the primary products prices. March traditionally opens the half year of the gold weakening, so traders should trade long on gold quite cautiously. Evidently, there are other instruments that will be more profitable.