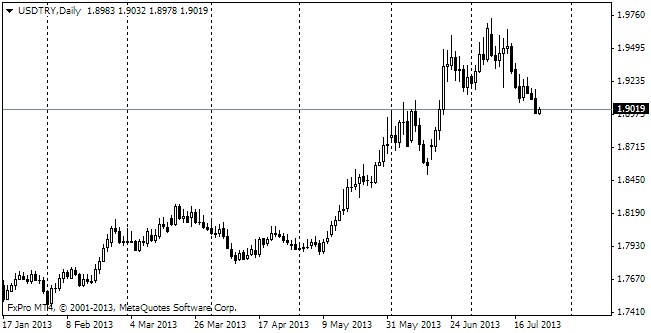

usd/TRY

Emerging markets are on the defensive now. The capital outflow from such countries as India and Turkey made their CBs sharply raise the interest rates, thus making investment in these currencies more attractive. Last night the Turkish CB increased its overnight lending rate from 7.75% to 12%, and one-week repo rate from 4.5% to 10.0%. This measure, surprising in its scale, boosted a rally in the emerging markets and supported strengthening even of such currencies as the Australian dollar. Albeit at a smaller scale, yesterday the Russian CB conducted interventions at approximately a billion dollars, along with that exceeding the permissible threshold of the rouble's decline against the dollar and the euro straight by 15 kopecks instead of the traditional 5. There's hardly a country that would love facing the problems which Argentina is confronting now – its currency has become thrice as cheap since last May and the country's government has to officially control the size of earnings which can be paid in the foreign currency (now it is one-fifth). Let's get back to the Turkish lira. The expectations of decisive measure from the Turkish CB enabled USDTRY to go down from 2.39 to 2.25 and the measures, which eventually proved to be even more courageous, spurred further development of the movement, taking the pair to 2.18. As a result, the lira grew against the dollar by almost 8%. The late-comers are obviously punished.

EUR/USD

In the current situation it is easy to detect reasons – the intention of the US Fed to cut the bond-buying programme while the economy is growing. It made investment into securities more beneficial. The same situation is observed with euro investments. The region doesn't suffer such a strong pressure in the market of sovereign bonds as a year or two ago, the banks have a chance to attract money, improving their balances. As a result, the yield/risk indicator has shifted in the direction of the markets of the developed countries, where most assets are nominated in the euro or dollar. Yet, investment into these currencies are almost balanced. Note that the troubles in the developing markets haven't stirred any significant reaction in eurusd in the recent weeks. Anyway, the balance between the euro and dollar may change today as the Fed is expected to take a further step to cut the monthly size of bond purchases. Lately we've seen many signs of a certain hitch in the US recovery. Besides, the issues in the emerging markets are rather big. Eventually, today there is a risk that fomc will be more dovish than expected by the market participants. Anyway, it is more likely that the programme will be cut, which will strengthen the dollar. The large emerging markets have enough means to defend themselves from capital outflow.

GBP/USD

The British GDP stats published yesterday failed to meet the market's high expectations. On average analysts expected to see the third consecutive quarter of the GDP growth at 0.8%. The actual data proved to be a bit worse. Because of bad weather the construction sector showed contraction, but the latter is likely to be recouped in the coming months. The real sectors grew by 0.7%, the services sector -by 0.8%. The latter has been displaying faster growth in the last four quarters. Thus, the pound has justified its high rate against the euro and dollar in the recent weeks. The only things that can curb its further growth are strength of USD and dovish comments of the BOE's officials.

USD/JPY

Growth of the Asian markets contributes to appreciation of usdjpy, which has already risen to 103.40. The growth could have been more impressive, but for yesterday's poor stats on durable goods orders in the USA, which in December shrank by 4.3% against the expected growth to 1.5%. This way or another, the pair is growing less vigorously than at the end of the previous year.