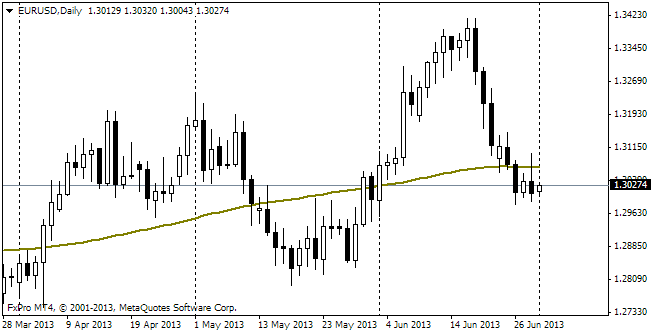

EUR/usd

ECB chief Mario draghi made it clear that he remains dovish at yesterday's press-conference after the rate decision. When commenting the decision he pointed out that the Bank is ready to take action in case of need. These words gave rise to selling of the euro as traders had expected more optimistic comments after a series of positive data. However, Draghi explained that a couple of positive PMIs, which have just entered the positive territory, doesn't imply large-scale growth of activity and doesn't affect the Bank's forecasts on the EU economy. Also Draghi is right repeating that he will keep the rate low for a long time as the regional economy has just popped its head out of water and is far from the moment when policy toughening will be needed. It is also noteworthy that according to Draghi's words if Greece asks for the third bailout package, it will be done on special terms, which will be discussed then. Other EU officials also confirmed that capital injection into this troubled country could be required at the end of this year or at the beginning of the next one. Affected by all the peripeteias in Europe eurusd fell from the daily high of 1.3222 to 1.3110. Yet partially this decline took place due to US statistics. Non-Manufacturing PMI grew to the level which hadn't been observed since January 2011. The ADP data, published a bit earlier, showed the lowest growth of employment in the private sector over the last three months. This situation hardly reflects stronger activity. Here we can rather speak about some stabilization, nothing more. But still the markets realize that ADP can sometimes deliver non-correlated results with official data. We are waiting for payrolls, only they may help to ruin expectations of the change in the Fed's policy.

GBP/USD

The market doesn't believe Carney. After the publication of the decision on the interest rate and QE programme the pound flew up by 50 pips in USD. Then, however, this growth was levelled, when the sterling was pulled down by the single currency and afterwards by the ISM statistics. Today agitation in the pound may start before the payrolls, as there will be a release of trade balance and industrial production stats.

USD/JPY

Investors, which have been selling the yen since the beginning of the week, has gone on the defensive, preferring to take their profits. The pair has again dived below 100 and left the zone of overbuying, which is a bearish signal. Anyway, we recommend to be cautious as the pair remains inside the upward channel. Besides, employment statistics can ruin any technical picture.

AUD/USD

The Aussie is also on the defensive, having failed to break through 0.92 on Wednesday and Thursday. Bulls have adjusted their positions in the anticipation of the evening statistics. Leaving the news from abroad aside, we should mark improvement in the Australian indicators, which should moderate expectations of the monetary policy softening. Besides, now Aussie-investors focus on the coming elections and have no time to think about the USA.