EUR/usd

Fortunately we were mistaken about draghi yesterday. His comments on the rate decision and answers to journalists' questions made it clear that the ECB is ready for action. As opposed to the press-conference in March, Draghi didn't sound optimistic. On the contrary he pointed out that the inflation slowdown proved to be an unpleasant surprise for the Committee and said that deflation or even a long period of low inflation is a very dangerous thing, which the Bank is going to combat. He added that various unconventional measures (expansion of the ECB's balance sheet via asset purchases, rate cuts and even negative interest rates) were also considered. He didn't specify which instrument was a priority one, only saying that all of them are used for different purposes and have different effects. In our previous reviews we spoke a lot about the need in policy easing due to worsening in the performance of the periphery. The main danger was that the ECB wouldn't hear warning signals from the periphery. Italy's Draghi anyway discerned unemployment growth in his native country, slowdown of consumer activity in other countries and the threat posed to the periphery by the expensive euro. Thus, we are now sure about easing of the policy at the meeting of ECB in May, which should put pressure on the single currency. Yesterday's decline to 1.3700 seems to be just the beginning of the continuous downtrend. If today's data on the US employment at least meet the forecasts (about +200K), the dollar will get an extra incentive for growth, which will echo in all the markets, and eurusd will go down to 1.3600. Probably, it won't happen today, but quite likely till the middle of the next week. As you remember, the euro's depreciation meets our expectations of decline to 1.30 by the middle of the year.

GBP/USD

Our caution regarding the British currency proved to be quite reasonable. The cable is getting blows exactly from where it got support earlier. None of this week's PMIs met the forecasted rates. In our opinion, it is quite logical since the EU economy, which gives over 60% of the total turnover, stopped gaining growth momentum. Britain eventually was to suffer similar pressure. Again we remind that the rates keep indicating impressive economic growth. Simply the performance became less pronounced and the actual data stopped surpassing expectations, falling short of them more and more often.

USD/JPY

Yesterday the yen spent the day without any sharp movements. The pair froze at 103.90. The attempts to break above 104 have been futile so far as the main agitation was about the EU currencies. Today the situation may change. We can see some desire to take profits in the market, but it will depend much on the US employment data. There is a feeling that should the dollar grow, usdjpy will lag behind the market and in the opposite situation will decline more than the others.

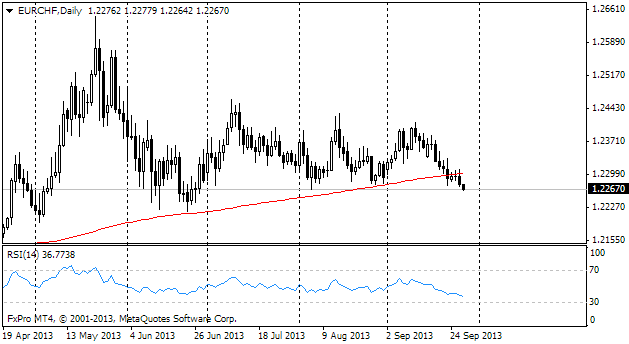

EUR/CHF

The pair preserves negative correlation with the euro. When the euro/dollar is put under stronger pressure, the euro/franc grows faster. Now the pair is trading at 1.2235, which hasn't been seen for almost two months already. Its return to 1.2300 looks quite normal and decline of EURUSD to 1.3600 may contribute to it.