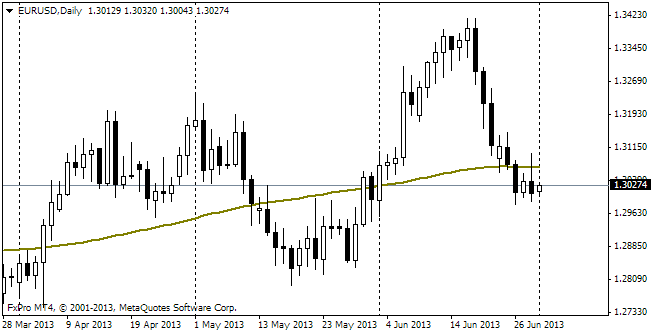

EUR/usd

Turning back to Monday's opposition of technical and fundamental signals, we can see that the former is winning (at least now). The US dollar continues the attack. EURUSD again dipped below 1.30 yesterday. Now it is trading at 1.2970, which is close to the lows of early June. The bears showed an impressive performance yesterday near the 200-day MA (1.3070). This was provoked by an article in Reuters, which said that the troika was again displeased with Greece's progress on the way to budget consolidation and that the country got an ultimatum within three days to agree to the afore-discussed terms or risk doing without the next tranche. While the British media (FT) failed to heave a new wave with Italy and its unaccounted debts, the US Reuters easily produced agitation among investors with the old topic. The fact, that already this Thursday the ECB will hold a meeting, may even worsen the prospects of the single currency. If the scandal around the region's periphery was going on for some time now and we saw some impact on the financial and debt markets, we could expect from draghi some statements to stop the discontent or some definite measures to stabilize the situation. And now – in the very beginning – we can hardly expect that the ECB's head will apply rate cuts or other non-standard measures to calm down the markets. Moreover, the recent economic data may set the Governing Council at rest, taking it farther from launching another portion of stimuli than a month and, more so, two months ago. All this will be on Thursday and today be careful on the release of employment statistics by ADP. Strong data may provide additional support to the US currency.

GBP/USD

The sterling's consolidation near 1.52 has held even less than two days. Already yesterday during the EU session the pair resumed hitting fresh four-week lows. We can hardly attribute it to Construction PMI, which fell short of expectations and grew from 50.8 to 51.0. Nevertheless, above 50 there is a zone of growth. Today we'll get more important statistics on activity in the services sector. Probably, the final PMI for Europe and the estimate of activity in the services sector will manage to get more admirers for the sterling. A slight decrease from 54.9 to 54.6 is expected, yet these growth rates are still quite favourable. The similar index for the eurozone has been dangling below 50 for a year and a half.

USD/JPY

Yesterday the yen broke through the level of ¥100 per dollar. Because of the general market tendency to purchase USD we didn't see the expected consolidation at that “round” level. Anyway, the indicators signal that the pair is overbought, so our recommendation remains the same – be careful with buying.

AUD/USD

Having gone below 0.91, the aussie is now hitting fresh almost three-year lows. The trade balance which surpassed expectations (0.67bln instead of the forecasted 0.05bln) failed to attract traders' attention. They were more interested in Stevens' speech, where he highlighted difficulties with shifting of the economic engine from the mining sector.