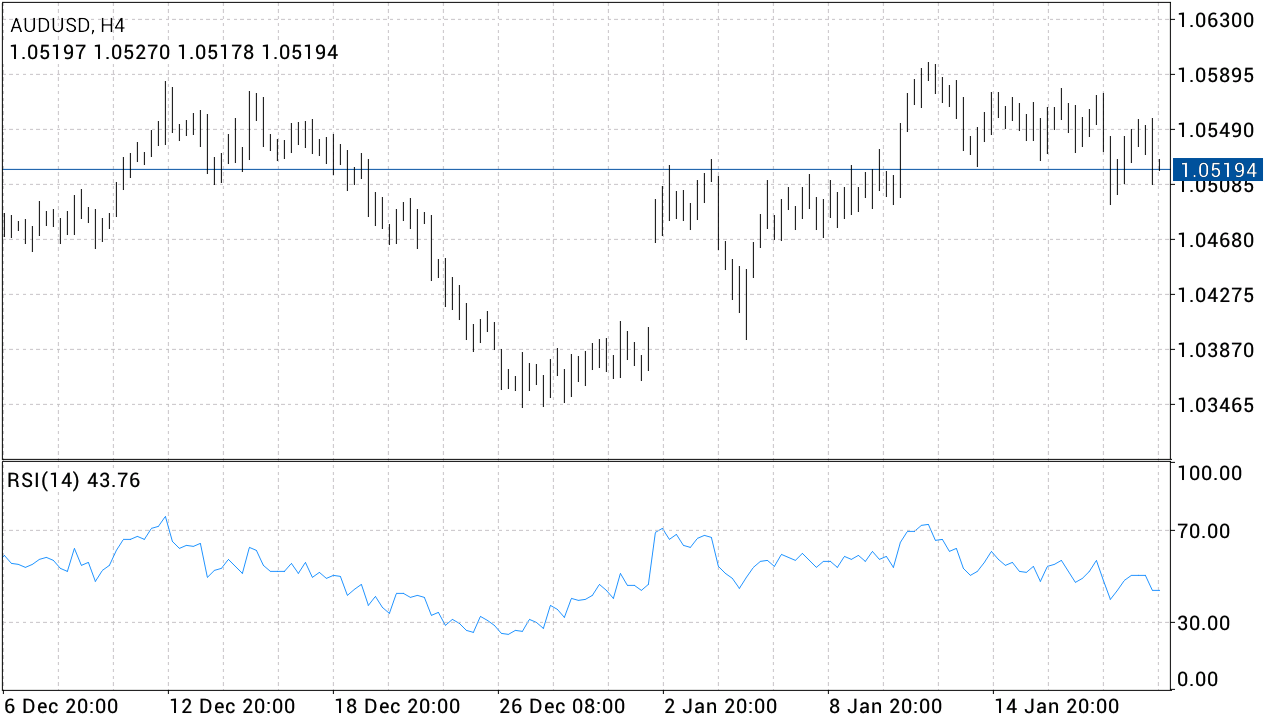

EUR/usd

The market didn't disappoint our expectations – some instruments stopped retracing. The stock exchanges were hitting their 5yr highs, eurusd again threatens to break above 1.34. Now trading is held just a step away from these levels. As two weeks ago it was caused by rumours about quite a good demand at the Spanish auctions. In a couple of hours the information proved to be true, which further spurred the growth. However, we insist that it is just a cause, the real reason is different. Traders finished the phase of consolidation after the preceding big rally, reshuffled their positions and got ready to move further. Now it remains to see if the euro will be strong enough to break through 1.35 or not. There are almost no doubts that the demand is caused by the capital flow from francs and pounds back into EUR. Please note that the waves of growth in the euro are going along with a much larger upsurge in EURCHF and general slackness of the pound.

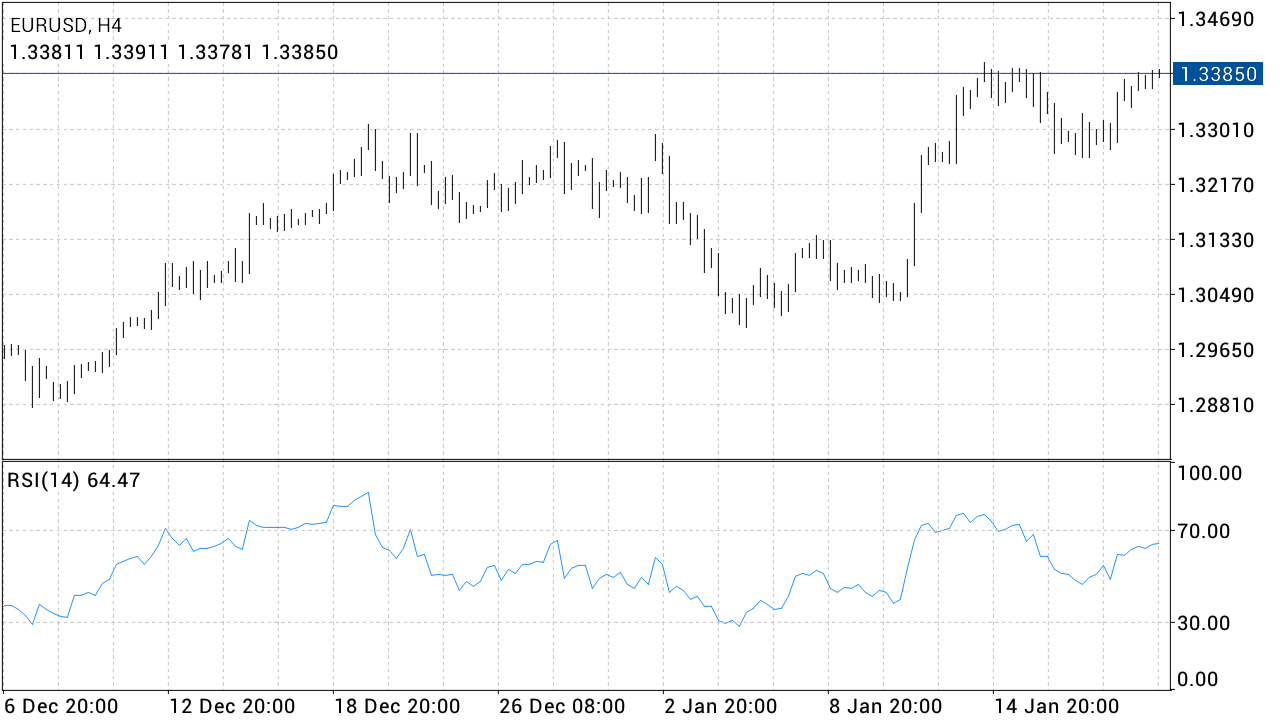

GBP/USD

The sterling tries to hold out above 1.60, but succeeds only due to the recovery of risk demand in other markets. According to our yesterday's big picture, the pound index is likely to go down in the coming weeks. The ungrounded overbuying of the pound last autumn is being corrected at the moment due to the country's weakness. Thus, even if the dollar is weak enough not to appreciate against the pound, the latter will depreciate against other majors.

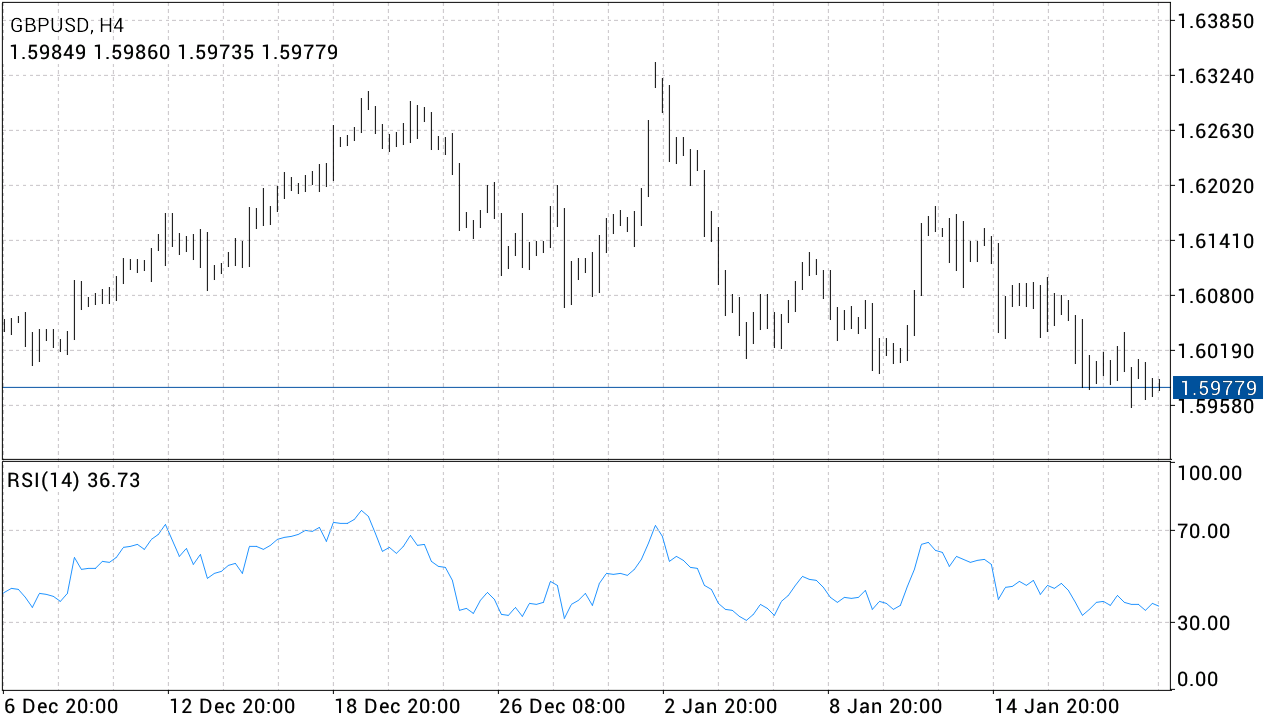

USD/JPY

The Japanese officials, who provoked the correction at the beginning of the week, on Thursday hurried to take their words back, claiming that they were misunderstood and that the yen rate was just in the middle of the correction according to the major growth indicators. The yen-bears quickly took the bull by the horns and pushed usdjpy already up to 90. As expected by many, the beginning of the week was just a short respite on the long way of devaluation.

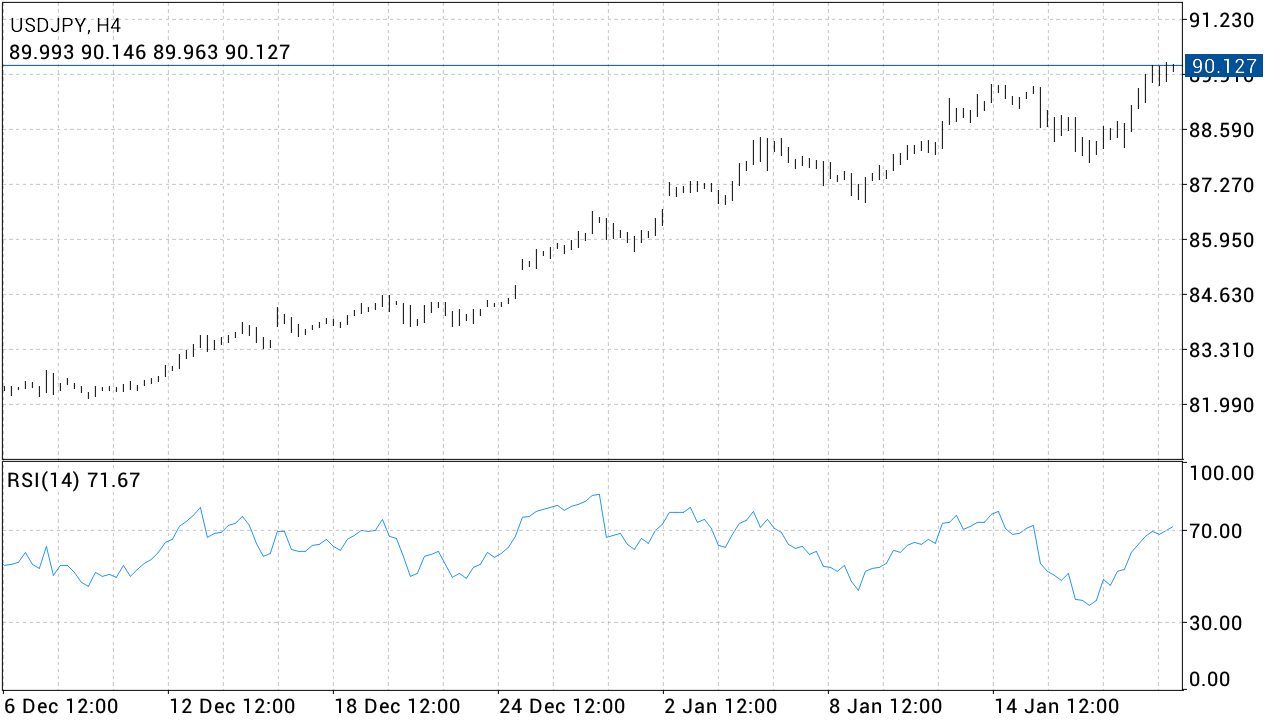

AUD/USD

Yesterday the aussie was punished by the employment statistics and eventually dropped down to 1.05. The only thing that helped the AU dollar was the general demand for risk, which dominated the markets yesterday afternoon. We still believe that the Australian CB will regard the economic slowdown in the country as a cause for cutting the rate at the beginning of February. However, until then we may see the fight for the resistance of 1.06.