EUR/usd

Syria is still hitting the newspaper headlines. oil grew impressively pushed by the threat of a large-scale intrusion into this country and also by the forecasts of investment banks and hedge funds. Rates of Black gold may rise even higher, to 125 in the coming days and to 150 if the regional conflict expands, in the opinion of Societe Generale. Anyway, outside the oil market this threat is hardly felt. Of course, the market looks a bit more jumpy than in the previous days, but this is only in comparison with the summer lull. eurusd remains squeezed in the 1.3300-1.3400 corridor. However, the chances that the exit from the corridor will be down rather than up are growing. The upward move has lost its impulse. Besides, European consumers have become a bit more cautious, which is reflected in yesterday's statistics. Thus, the leading indicator of the consumer climate in Germany by GfK has dropped from 7.0 to 6.9 by September. It is a trifle as the current rate is quite high, anyway a rise to 7.1 was expected. In addition, it became known that instead of the expected growth Italian retail sales have demonstrated decline. Against the previous year the sales have shrunk by 3.0% while it was forecasted that they would drop just by 1.2% (the preceding statistics have been seriously revised). At the same time, the ECB's statistics showed that the number of issued private loans in the eurozone keeps decreasing. The decrease against the previous year has expanded from 1.6% in June to 1.9% in July. Such poor rates have never been on record. Optimists may think that it is temporal as money supply is still growing and may eventually be put into circulation. Anyway, we'd rather warn that it is not for sure. The money supply is more likely to be directed by the EU banks to pile up reserves for sour loans or to write off bad debts. So, growth of money supply will not necessarily entail lending growth in the eurozone. The ECB obviously doesn't take enough efforts in this regard.

GBP/USD

Carney is losing out to the markets. Yesterday the BOE's head repeated the idea that the markets were wrong in their forecasts regarding the beginning of monetary policy toughening by the Bank. He meant the sharp increase of interest rates in the British debt market, which, generally speaking, is largely connected with the behaviour of interest rates in the USA rather than with the reconsideration of the time when toughening in Britain will start. On the whole, while Carney is only seeking ways to assure the markets that loans will remain affordable and doesn't offer any specific decisions, the pound will remain a currency, devoid of any idea and prone to outside influence.

USD/JPY

The debates on the sales tax increase in Japan continue, in the meantime the published statistics once again have showed that consumers are rather cautious with spending. In July retail sales dropped by 1.8%, having lost 0.3% against July 2012. The yen bounced off 96.70 and is now trading at 97.80. The nearest strong support is at 98.80 and will hardly be reached today.

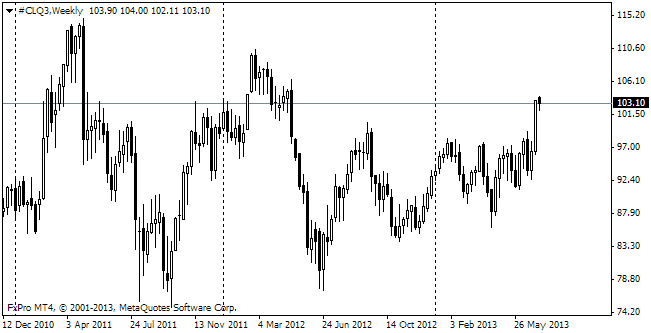

Oil

Oil grew by about $9 per barrel during the last rally. However, in our opinion, this rally doesn't seem to be steady. Those, who have missed the most part of the move, will be much safer when standing aside. For example, yesterday the American WTI jumped up to $112 in the morning, but at the end of the day it was already again at the level where trading had started, that is at 109.50. Earlier in the previous two years Oil reversed from these levels, despite the Arabian spring and other destabilizing factors.