EUR/usd

It's an important day for the markets today as they are expecting a release of the US employment statistics for July. Some commentators have even called this report to be the most important in the year. It's too much, of course, but eloquently speaks about what agitation today's data are arousing. In the second quarter they were very reassuring, surpassing the expectations, but that was preceded by the horrible statistics at the beginning of the year. The economy generally repeated that trend, as is obvious from the GDP rates, which proved to be the worst among the non-recession periods. Anyway, Wednesday's data for the second quarter showed quite a decent growth. Employment statistics, as we see, are a very effective leading indicator and therefore attract so much attention. Besides, there is some uncertainty about what the rates will be. On the one hand, the data on weekly unemployment claims have been perfect in the recent weeks. Even yesterday's growth by 23K should be considered coupled with the lowest rates since 2000 (279K) a week ago. The four-week moving average has dropped below 300K, which was last seen over 8 years ago. So there is no doubt that the labour market is warmed up. In this regard yellen's caution looks excessive, when she speaks about the persisting lag. Most likely, she simply doesn't hurry with the policy toughening not to carry it out when the economy starts its natural slowdown. For instance, yesterday the stock markets fell under pressure, showing the greatest decline since February against the background of the poor US corporate reports. The major risk, in our opinion, is posed by the lower rate of hiring (as it's been reported about large-scale reductions in HP and Microsoft) and also by the increase in workforce due to fresh graduates. This growth can negatively affect the unemployment rate. With such basic data it is easy to stake on USD's growth, should employment gobeyond expectations. Yet, we think that the most likely scenario is a pullback on the poor data with the potential for EURUSD to grow to 1.3450/3500 in the coming 2-3 trading sessions.

GBP/USD

The pound keeps falling. The pair has been depreciating for 11 out of the recent 12 days (today excluded). Yes, we have spoken about such a possibility and have been expecting it, but still have to remind that movements without pullbacks are very seldom in Forex. Most likely, employment statistics can become a good reason for the short-term profit taking after the dollar's recent rally. Though upon the whole the trend remains in favour of USD, in our opinion.

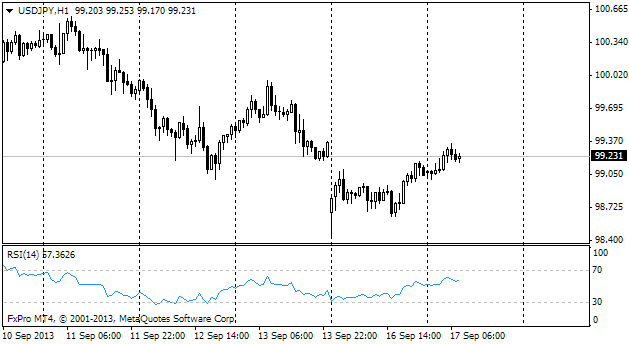

USD/JPY

usdjpy is forming a flag pattern. It is considered to be a consolidation figure within the range of the recent trend (in our opinion, growth) before the further move in the same direction. If it happens this way, it will be a confirmation of the end of the multi-month sideward trend in the pair. Anyway, we now treat this scenario with caution, willing to see the employment stats first.

AUD/USD

Yesterday poor aussie sank below 0.9300 due to the weak economic data. It turned out that the labour market is slowing down even with the current interest rate and inflation is expanding the space for maneuver of the RBA. Besides, we shouldn't forget that the Bank has frequently expressed its will to see the rate of the national currency much lower than the current rate. We only have to understand if the US dollar will continue its ascent.