EUR/usd

The revised statistics on the US GDP in the first quarter proved to be even worse than that poor growth rate of 0.1%, which we saw a month ago. The revised data showed that the economy was shrinking at the pace of 1.0%. These data are really poor, yet they were soon diluted by quite favourable employment data. The weekly unemployment claims decreased to 300K, which is much better than the expected 321K and the preceding rate of 327. The continuing claims are still in the downtrend, making now only 2631K. This unemployment downtrend was exactly that very factor, which outweighed the negative regarding the dollar. Yet, despite the fact that the GDP data are comprehensive, they give us the picture of the past. The employment statistics are considered to be a leading indicator, promising us favourable rates for May. And this is important before the labour market statistics, expected in a week. Today market participants can get interested only in the consumer confidence data. The revised rates by the UoM can stir the market if different much from the preliminary rate of 81.8. In the coming days traders should pay more attention to the EU inflation statistics. Today we expect a release of the inflation data for Italy, on Monday – for Germany and on Tuesday – for the whole eurozone. Should the data prove to be poor, it may put some extra pressure on the single currency, dispelling the intrigue about the ECB's meeting next Thursday. This day is likely to be relatively quiet. Trading is held close to 1.36, but there can be attempts to return to 1.3640. Let's see how long the bulls will hold out. Now it looks as if the situation was under the control of bears.

GBP/USD

The pair was protected from falling below 1.67 yesterday. Adding here the similar defence a day before, we get quite a tangible line, which bears are unable to cross. Technically, the cable has been falling too quickly this week, there simply hasn't been any sound reason on the part of fundamental factors. And it means that behind the decline there could be profit taking or liquidity collecting to try another attack. Though we generally have a bearish view of the pair, we also understand that the pound can't look weaker than the euro, approaching its first rate increase (expected already at the end of the year), while even the Fed is expected to do it in mid 2015.

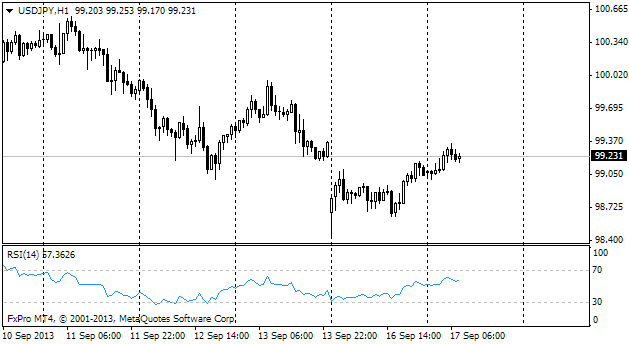

USD/JPY

The consumer inflation in Japan was affected by tax increase. The annual prices flew up to 3.4% in April from 1.6% a month before. But it is hardly the result, the BOJ wanted to achieve, launching QE a bit more than a year ago. However, this effect on the part of prices dissuaded investors from extending the current incentives. Other indicators at the same time are under severe pressure. The consumer spending has decreased by 4.6% annually and production has shrunk by 2.5% this month.

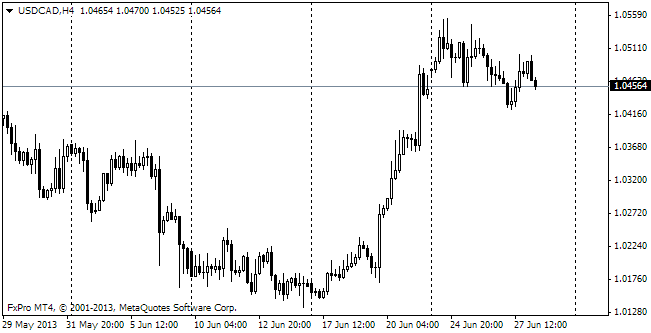

USD/CAD

The canadian dollar has been in relatively good demand lately. Even USD's growth against most of the currencies doesn't prevent the Loonie from trading at the weekly lows. It's quite possible that this trend will be stopped by poor data on the Canadian GDP for March and the first quarter, if they prove to be much worse than the expected +0.1% and 2.0% respectively.