EUR/usd

Players are gradually taking their profits after selling of USD. As we know, the market can go against fundamental factors for a while if technical analysis presupposes such a movement. Something like that was observed yesterday in the euro/dollar. The Prelim PMI for the eurozone was not bad. Despite the disappointment with slower growth of Germany's manufacture, where the index has fallen from 51.8 down to 51.3, the services sector has surged, demonstrating the highest activity since last February. And it's been only the third month for the last 2 years, when Germany's services sector improved so much. So, the news actually should have told positively on the euro rate, but instead market participants pushed the pair down by about 40 pips over 15 minutes. The release of data for the whole eurozone didn't help either. Here the services sector is also growing rapidly, which follows from the maximum rates of Services PMI and PMI Composite over the last 2 years (both at 52.1). All this news didn't save the pair from a drop down at the end of the day. First of all, there is a growing realization in the market that Merkel will have to make concessions to form a coalition. Then, the upward move on the payrolls at the beginning of the month hasn't undergone any significant correction. Small speculators , who staked on a correction in the near future, apparently have been thrown out by the movement in the middle of the last week. Thus, now it is a good time for massive selling of the euro, which can be easily done against news on growing demand. That's what we saw yesterday. The pair was gradually sliding down to 1.3480, though during the European session it was seen that bulls were fiercely defending the level of 1.35. In our opinion, we should be ready for gradual sliding of the single currency to 1.34 in the coming days and during this week and at the beginning of the next one it is quite likely that it will drop further down to 1.33. It is significant that the pair has stopped hitting highs and instead is setting fresh local lows.

GBP/USD

The pound proved to be much steadier in comparison with the euro at the beginning of the week. On the other hand, it had moved off the highs earlier, so it wasn't of primary importance for traders. As a result, the pair after going below 1.60 at the end of the last week still managed to return higher. Today three members of the BOE are to give speeches. Let's see if they will manage to convince markets that the situation in Britain is not as good as it seems.

AUD/USD

The pair doesn't feel the need in buyers, but is growing rather cautiously. The drop at the end of the day yesterday didn't change the situation much: the pair is being purchased on the dips. The current levels still look attractive for buying. Let's risk to set a target: already before the end of the year audusd will manage to break through its 200-day MA, which is now at 0.8050.

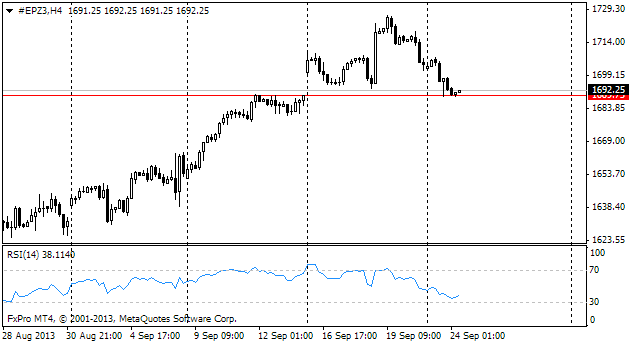

Yesterday the index closed the gap, formed on the news about Summers' withdrawal from consideration from the Fed nomination. This profit-taking let the market go out of the overbuy zone, which will help to keep the markets afloat. But be careful as there are lots of risks, which may significantly decrease stock prices – from debt ceiling and the Fed's stimulus rollback to the sovereign debt crisis of the eurozone.