EUR/USD

The US stock markets are still suffering heavy selling. Bulls are retreating not only because of the expectations of QE reduction from the Fed, but also because of the unimpressive corporate reports. Index futures have an opportunity for a respite only when the US trading session is over. It was yesterday and the same movement we can observe today. The euro/dollar keeps ignoring fluctuations of stock indices, which is not typical of this pair. Yesterday the currency made another attempt to find demand on growth. The attempt proved to be futile, the pair was turned around straight above 1.37 with the intraday high at 1.3717 (on Friday it was 1.3738). After that the rates werepushed a bit above 1.3650. Germany's Ifo stats turned out to be better than expected, confirming growth of the country's business sentiment to two-year highs. But, as we see, it was not enough to buy the euro against the dollar. Since the end of the US session the pair has been fluctuating in an unbelievably narrow range, obviously waiting for new drivers for growth or decline. Yesterday's meeting of Eurogroup and today's meeting of Ecofin (a meeting of the EU finance ministers) again gave rise to talks about solvency of Greece. Anyway, this factor doesn't have such a profound effect as it had a few years ago in no small part because the Greek fire doesn't threaten other countries any longer.

GBP/USD

The BOE's officials try their hardest to impose the idea that tapering is not as close as supposed. However, numerous mistakes in forecasting of the preceding macroeconomic factors do not speak in the Bank's favour. For instance, from 2009 till 2013 inflation was much higher than predicted by the BOE. Then, as Carney and Co promised, the interim threshold rate of unemployment, which was set at 7% in July, was not to be reached before mid 2015. Yet in half a year we see it already at 7.1%. It is quite possible that in February we will see another big correction of the forecasts. Today the market's attention will be reverted on the release of the initial GDP estimate for 4Q. It is supposed that for the third time in a row the quarterly growth will make 0.8%. For the pound to stay that high the index should meet or surpass the forecasts. In the preceding four years it always rolled down after a few attempts to break through 1.65.

AUD/USD

Good news – that's what the Australian dollar has really lacked lately. At first sight today's message about growth of the NAB Business Conditions index to the highest rate for two years and a half can be reckoned among positive data. The index grew by 7 points from -3 to 4 in December. However, in their comments NAB do not sound very reassuring, referring to the influence of short-term factors like pending orders and the impressive decline in the currency. In our opinion, the effect of the low currency rate and low interest rates should be already filtering into the economy, telling not only on blowing of a housing bubble, but also on the affairs of the corporations. In its turn, it can make the RBA slow down with further rate cuts. It is hardly possible that it will take place in February, meaning that the aussie has a chance to consolidate.

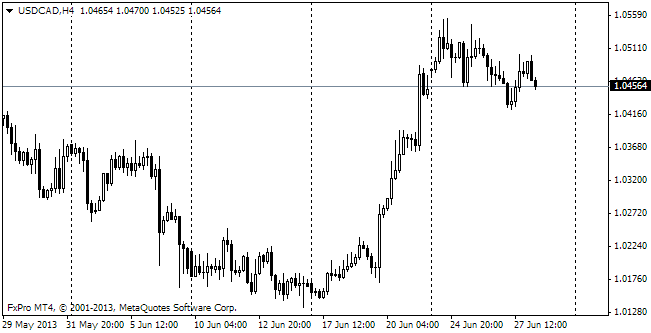

USD/CAD

The Canadian Loonie, another martyr of this year, has stopped fixing losses and is again ready to head down against the US currency. Friday's correction developed further on Monday. As a result, usdcad fell for a while to 1.0130 from the high of 1.1173. Now again trading is held above 1.11, mainly because of risk aversion during the New-York trading.