EUR/usd

Signals of economic activity subsidence after a slight surge in spring keep coming from America. Following the decline of new home sales (by 13%), goods orders also sharply decreased. This index lost 7.3%, which is twice as much as the expected correction of 3%. Besides, the growth rate a month ago was also revised down. All in all, yesterday's drop crossed out more than half of increase in goods orders over the preceding three months. In connection with these statistics the following question inevitably comes to mind: weren't the data on acceleration of the US economic growth in the first half-year treated too optimistically? Probably, recovery was wrongly seen in the short-term upsurge, which will develop once again now just like in the previous years. Even taking into account that the number of jobs has grown and, as a consequence of this, the number of spending Americans has also gone up, we shouldn't forget about the need in reduction of the budget deficit. So, there's a new threat, that is the approaching lending threshold, which is likely to entail reduction in spending in the short term and also arouse the need in structural reforms. News on the slowdown in the USA gives rise to short-term depreciation of USD, but then pessimism spreads to other markets, provoking selling of risky assets. Yesterday, after the release, EURUSD jumped up to 1.3394, but soon returned to 1.3365. This morning we see attempts to break below 1.3350.

GBP/USD

The British pound is trading within a very narrow sideway channel, being too weak to come off 1.5570 already for two days in a row. This calmness of traders in regard to the British currency is a result of the news vacuum in London and also of Bank Holiday yesterday. Technically the currency remains above its 200-day MA in gbpusd and GBPJPY. Anyway, the pound is weaker than its European vis-a-vis – EUR and CHF. The power balance is not in favour of the British currency, so when volumes are back in Forex, the sterling may suffer a stronger pressure.

USD/JPY

The yen keeps appreciating, which is supported by the defensive mood of stock markets and a higher degree of geopolitical instability. The pair remains high in comparison with last year's rates (+25%), but anyway, when considering a smaller period, we can see a line of downward support, off which the pair pushed at the end of the previous week.

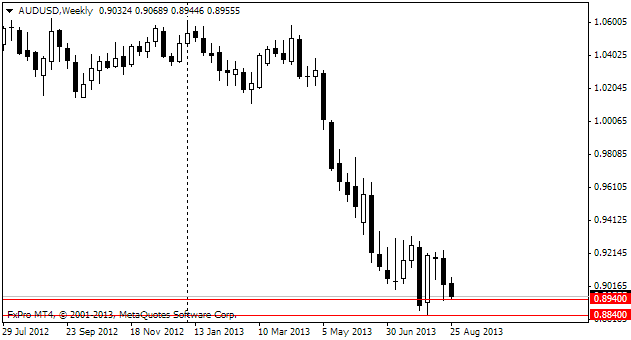

AUD/USD

The Australian dollar failed to consolidate above 0.90 yesterday and then was abruptly thrown by bears from 0.9070 down to 0.8945. The nearest support is at 0.8930 ( last week's low), the farther target of bears is at 0.8845 ( the low of early August). Below is vacuum with many-year lows.