EUR/usd

Yesterday trading in the currency market was going on under the flag of measured consolidation after recent fluctuations. The dollar index (DXY) has rolled back from the three-year highs, reached on Friday. Anyway, commentators are almost all unanimous in predicting the further dynamics of USD. The continuous stream of favourable news releases each time reminds of the upcoming end of bond purchases by the Fed. In addition to Friday's data yesterday we got Consumer Credit statistics from the federal reserve. It was reported that the consumer debt growth in May made 19.6bln against the expected 12, having become twice as quick as in April (10bln). The basis of the US growth in 1990s and 2000s was consumption. Manufacture was reducing the number of jobs , while the services and construction sectors, on the contrary, were demonstrating impressive growth. When the crisis came down many thought that America would change the paradigm in favour of manufacture. However, now it's clear that if this happens, it happens more than leisurely. The statistics we got in the recent months pointed at job reduction in manufacture (over the last 4 months it made 24K). It's 0.2% of all people employed in these sector. Compare it to the growth by 0.7% in private business (+751K). Let's add to this a very high level of consumer confidence ( actually, it was right the reason for the strong growth of consumer lending) and impressive rates of growth in the real estate industry (prices, sales volume and construction). Americans are again spending, so mortgage agencies and banks don't need the Fed's support as much as before. The beginning of the corporate reporting season seems to be nice as well. We, just like many others, believe that the Fed will start the stimulus rollback soon. Yet, we expect that it, most likely, will be in December rather than September because there's no price pressure.

GBP/USD

Absence of important news yesterday proved to be favourable for the British pound. The market, influenced by the trend for correction (against the dollar) and consolidation (in crosses), has moved away from the extremums. EURGBP failed to reach 0.8650, but again got closer to the round level of 0.86. The cable (gbpusd) rose by a figure from the daily low at 1.4850, but then stopped growing and now is trading at 1.4930, waiting for the news on the trade balance and industrial production. These indicators may seriously affect the current state of affairs in the pair.

AUD/USD

With regard to the aussie we can make modest suppositions about formation of the double bottom at 0.9050. It can be true only if USD doesn't launch an attack in the near future. And the chance of this outcome is great. The Aussie-bulls may stake on the cross-rates as the currency has depreciated significantly in the recent months, but it is too risky to say that audusd won't go lower now.

oil

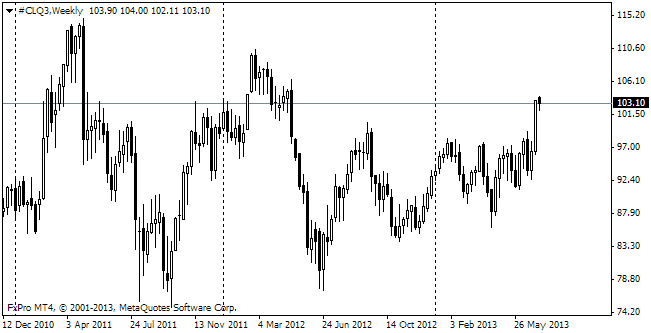

Oil is growing due to the strong statistics on the US consumption and also to the persisting instability in Egypt. Now it is 10USD away from the 200-day MA at 103 (for WTI). The bulls may try to take the price up to 106-110, where the commodity started a downward reversal in March-April 2012.