EUR/usd

Though the beginning of the day was far from good, the single currency nevertheless grew against the dollar in the course of the day. This morning a fresh tide of growth helped the pair go up to 1.3586. It is a bit above the high set at the end of the previous week, which speaks about bulls' success in winning back their positions. Their morale should be boosted by the hints of different ECB's officials at scanty chances of further steps from the Bank. We hear hints that the ECB will resume bond purchasing to its balance sheet at the very earliest in a year. Yet, it is more likely that we'll see bond purchasing to the balance sheets of the European funds already this year. But all this is up in the air yet. The bears (to whom we now belong) have long-term fundamental factors to their advantage. The euro has moved off 1.40 by more than 4 figures, though the measures announced at the beginning of the month haven't taken effect yet. Today the ECB holds another liquidity tender. There's nothing unusual about that. The change is that there won't be any further steps to sterilize this liquidity later in the week. In plain words, there will be more euros in the market. Already now it has led to decreasing overnight rates in the interbank. The primary aim of the ECB's officials has apparently been achieved. Yet, it should be taken into account that rate cuts are only a tool to reach the main target – to boost lending in the region. Bundesbank President Weidmann says that the fundamental factor here is unwillingness to take out loans and banks' uncertainty about the reliability of borrowers rather than the lack of funds.

GBP/USD

The sterling-bulls aren't eager to go far on the defensive. Yesterday and during the Asian session today the pair got support close to 1.6850. Today's release of inflation stats is of importance. Though it seems that their effect on the BOE's mood will hardly be significant . Even Miles, the ultra-dove, said that there is fat chance of rate increases before spring 2015.Regarding the BOE, it is all clear – the certainty about the need for rate increases is growing. The question is only about the sterling – if it is strong enough to resume growth.

USD/JPY

Abe has shot the third arrow of its reforms, announcing the long-awaited decrease in the corporate taxes. They were ones of the highest in the OECD countries. Of course, now there are lots of skeptics who say that such measures are too weak to radically improve Japan's prospects. However even they have to agree that it is better than nothing and that it can deter shifting of production from Japan to China and other Asian countries, returning the status of a net-exporter to the country.

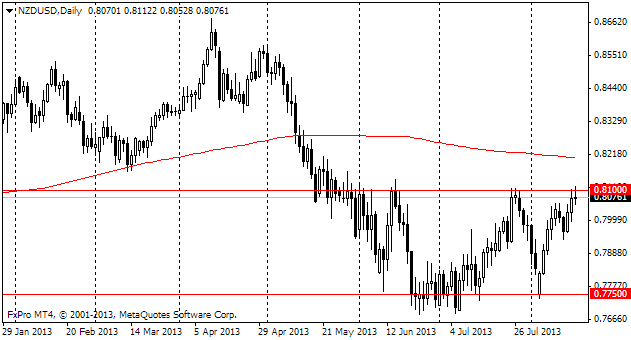

NZD/USD

The New Zealand dollar returned to the highs of April-May. He did it with the help of the RBNZ's hawkish statement last week, and also due to weakness of the US currency. With the latter we should be cautious.