Congratulations, we've made it through 2020! This eventful year is almost over. Let's take a moment to look back and recall its key events.

It's difficult to even start to comprehend how much this expiring year has changed our lives. We are all wearing masks and washing our hands several times a day now. If someone told us back in 2019, that we wouldn't be able to travel or even leave our house, we would laugh in their face. But we did face the lockdown and spent several months self-distancing, in isolation.

But apart from the much-hyped coronavirus, what other key events are worth considering? We believe that there were 3 major events in 2020, that had the greatest impact on the financial market, among them are:

- Australia's bushfires, that caused the aud's sharp dip and recovery

- 2020 US Presidential Election

- Russia-Saudi Arabia oil price war

Australia's bushfires

The bushfire season in Australia is the usual thing. So, when the wildfires started in August 2019, traders ignored this event. In early 2020, it became clear that the devastating fire season isn't over and is becoming a sheer catastrophe.

According to AFAC (Australasian Fire and Emergency Service Authorities Council) over 17 million hectares had been burned across Australia by February. The bushfire crisis prompted investors to start dumping the AUD.

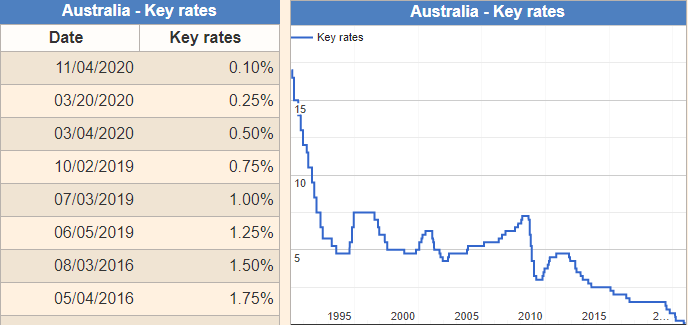

Market participants expected the RBA to start cutting its key rate, and these expectations were correct. To back the country's economy after the disaster, the Reserve Bank of Australia lowered its key rate to a record low of 0.10% and announced a quantitative easing program:

As it did, the Australian dollar began to weaken against the usd. But once the bushfires were finally extinguished, the AUD/USD pair began to rise:

All in all, the exchange rate of the Australian dollar decreased by 20% due to the pandemic and the bushfire season. As soon as the situation in the country began to stabilize, the AUD/USD pair skyrocketed by 40% and it keeps rising.

2020 US Presidential Election

The election of the new US president was by far the most anticipated event of the outgoing year. President Donald trump, the candidate from the Republican party was hoping to secure another four years in power. The Democrats chose Joe Biden as their candidate – an experienced politician who held the seat as vice-president during Barack Obama's presidency.

As a result, Joe Biden defeated Donald Trump to become the 46th president of the United States. Traders had anticipated such an outcome of the race and reacted in advance.

The S&P500 index which had been flat for two months finally escaped its consolidation range and began to rise:

To hedge against risks during the uncertain election time, market participants flocked in safe-haven yen and bitcoin:

On the charts, we have outlined the dates when Biden's victory was announced.

Trump is still trying to dispute the election results, claiming that the result was “stolen”. Meanwhile, president-elect Joe Biden's inauguration ceremony is scheduled for Wednesday, January 20, 2021.

Russia-Saudi Arabia oil price war

Oil prices began to fall as the novel coronavirus was spreading across the globe. At first, the price gradually decreased from $ 70 to $ 50 per barrel. Lockdowns prompted investors to focus on safer assets like gold, euro and yen.

On 5-6 March 2020, the petroleum-exporting countries including Saudi Arabia, Africa, the United States and Russia met at the 178th (Extraordinary) OPEC Meeting. For the first time in history oil producing countries failed to reach a consensus on oil output cuts aimed at achieving balance and stability in the oil market, harmed by the covid-19 outbreak. In response to Russia's refusal to reduce oil production, Saudi Arabia launched an aggressive price war, ramping up its output to record levels.

The markets were already affected by a major fall in demand due to the pandemic. With Saudi Arabia slashing its selling prices and increasing oil production, the collapse of the oil industry was inevitable.

On March 9, the market opened 11% lower, at $33 per barrel. For the next two months, the prices continued to drop. brent crude oil plunged below $16 a barrel, its lowest in over two decades, amid the market panic caused by oversupply. The price of West Texas Intermediate crude went into a tailspin falling by almost 300% on April 20 and entered an uncharted negative territory at -$37 per barrel, for the first time in history.

By the end of this year, both WTI and Brent oil managed to recover above the $50 mark, for the first time since March, although current prices are still 25% lower than in the pre-pandemic levels. 2020 will definitely go down in history as the year of global uncertainty. No one knows for sure what the future holds. What we can do – is learn from history. The economic downturn won't last forever. Any decline is usually followed by growth. The Australian dollar, oil prices, bitcoin and the S&P500 – all these assets fell to their record lows in 2020, but managed to regain a foothold and recover. Most economic forecasts also predict a recovery in 2021 after a sharp decline. Let's hope that these forecasts turn out to be correct!

Provided by AMarkets