As we all know, there are many different investment targets in the world. It can be felt that risks are different when trading different symbols . Many people believe that margin trading (CFDs like foreign exchange pairs) is a high-risk variety. Is that true? This article categorizes the risks of common trading methods (including foreign exchange transactions), which would be helpful for amateur traders.

Level 1 – Trades that do not require a stop loss.

Generally speaking, we cannot trade without taking risks, and the probability of success of a transaction is often not 100%. In order to prevent losing all their money, traders often need to set a stop loss on the trading orders. But there are always exceptions. In this world, there are some investments with a 100% probability of success. These investments do not need to set a stop loss.

For example, investing in “Real Estates / Local Currency”, “stock index / local currency” and “Simple Substance / Any Credit Currency” for a long term without using leverage.

When traders are thinking about a long-term underlying trend, they are actually thinking about the question of which currency has a longer life in a particular currency pair. One of the reasons is the inherent nature of the oversupply of credit currency. According to the long history of human civilization and the modern society, we acknowledged that credit currency would be replaced by another currency due to the regime change, and no credit currency would last forever. Therefore, the life of a country's credit currency is always shorter than that of its real estate and stock index. Inflation in Zimbabwe and Venezuela are two famous cases. In this circumstance, real estate and stock index market would normally be considered bullish in long-term. This is one of the reasons why Buffett insists on a long-term long strategy.

“Simple Substance / Any Credit Currency” is easier to understand. Simple substance is the basic particles that make up the real world. A mixture of coal and crude oil is unsustainable in long term. Lithium, silver, gold and cooper have played an irreplaceable and unique role in different stages of human history for thousands of years due to the unique physical and chemical properties of different elements. In the future, they will continue to play their roles and will always be demanded by humans, so their life expectancy is much longer than the credit currency of various countries.

When trading these underlying assets, if the trader does not use leverage, he can safely hold it in the long term without setting a stop loss. This is also an important reason why real estate, stock indexes, and precious metals are the most sought after in the world.

Level 2 – Trades that require a stop loss and the stop loss can be set.

Whether one uses quantitative short-term trading strategy or subjective short-term trading strategy, in the long run, it depends on its “core logic”. For example, a gambler guessing the size in a casino may earn profit in a short period of time, but we know that the underlying logic shows that the probability of wining is 50%, addition to the casino commission, the final profit and loss of the gambler must be negative.

Of course, trading is not exactly the same as gambling. If the “bottom logic” of the transaction is significantly higher than 50% in history, then as long as the operation is performed properly, the trader will eventually make profits. Note that although the winning percentage is higher than 50%, it can't be proved to be as high as 100%, so we can't bet all money on it. The correct approach is to place a small bet every time as we do not want to bankrupt sooner or later. In margin trading like foreign exchange trading, traders should “set a reasonable maximum stop loss ratio (such as a 3% stop loss in a single transaction).” All quantitative transactions and subjective transactions that meet this practice, will not be liquidated, as long as the maximum stop loss ratio is set reasonably and theoretically, no matter what the transaction is (such as leveraged stock indexes, leveraged foreign exchange transactions).

Level 3 – Trades that require a stop loss but cannot be set.

This kind of transaction is extremely confusing, and many traders will overestimate or underestimate the risk of this transaction. They come in a variety of forms, and none of them can set a stop loss. Their success rate is not 100%, so you need to set a stop loss. This constitutes a contradiction. The underlying or trading modes that meet this characteristic are long-term holding of bonds (interest-rate bonds are generally considered safe, mostly credit bonds here), long-term holding of stocks (note that individual stocks are not stock indexes), and Martingale strategies.

There are numerous cases of credit debt defaults and stock delists in the world. No one dares to bet all property on a certain credit debt or stock, because they may bankrupt at any time. The problem is that we cannot set a stop loss. If a stop loss is set, the logic of the transaction becomes a “short-term transaction” in the level 2 discussed above, which specifically refers to long-term holding of bonds to obtain interest or long-term holding of shares to receive dividends.

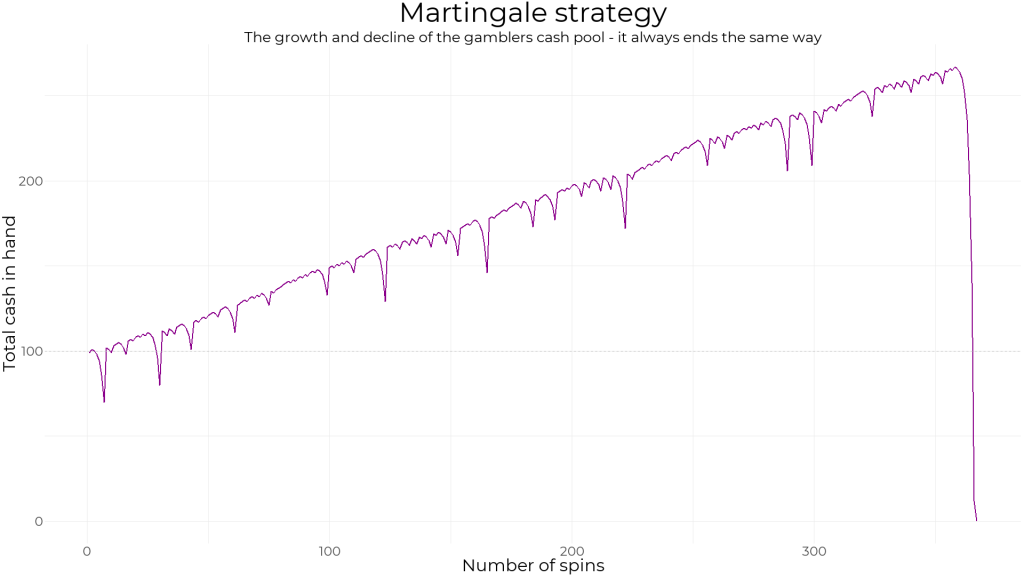

Martingale trading strategy is essentially the same as the previous two. Losing doubles and winning restarts the cycle, making the fund's curve (balance not equity) extremely neat, and no position closed loses money until all the money gone in the final transaction. Just like bonds and stocks, you can always earn interest or dividends before defaulting or delisting.

This kind of trade that needs to set a stop loss but cannot set a stop loss, we are forced to only artificially consider risking all the account balance as a stop loss. Simply put, a person with a net worth of one million dollars may only be able to pay 30,000 dollars to hold a certain stock, a certain bond or invest in Martingale trading strategies.

To Sum up, this article explains the risk situation of different investment targets. Many traders know that Martingale strategies are very risky, but in fact, buying a credit bond or an individual stock is no different. It is worth mentioning that the risk of margin trading like foreign exchange transactions, if the success rate is significantly higher than 50%, and the stop loss mechanism is reasonable, the risk is far lower than buying a credit bond or an individual stock.