EUR/usd

Yesterday was marked by an interesting fight between bulls and bears. The dollar has a good chance to grow due to the coming stimulus rollback by the Fed. At the same time, the single currency is also getting some good news. The preliminary PMI rates for the largest countries of the eurozone proved to surpass the expectations and grew against last month's rate. Manufacturing PMI for the whole eurozone hit 51.3, but the biggest contribution was made by improvement in Germany, where that index rose from 50.7 to 52.0. However, these rates (exceeding expectations, by the way) failed to prevent the attack of bears on EURUSD. The pair tumbled from 1.3360 below 1.33 in the heat of the EU session. Yet at that level it found a support and managed to hit new daily highs, at some point reaching 1.3370. And still today's market is dominated by the bears, who are again driving the pair to the support. Quite an interesting performance was demonstrated by the US stock exchanges. There we could also observe fierce fighting between bulls and bears. After the first minutes of growth in S&P 500, it began to decline and, as a result, went into the red zone. Anyway, from the very beginning of the Asian session the index was gradually growing. Also note that along with it Forex was rushing from decline to growth and now it is in the mode of slight profit-taking. Yet, it can be still hoped that this week will be closed positive by stock exchanges. In the meantime, EURUSD may break even for the second week in a row, though this time with a long upper shadow ( last week it was a long lower shadow).

GBP/USD

The pound was more obedient. It can be easily explained by the absence of news on the British economy yesterday. Thus, after the downfall following the release of the Fed's meeting minutes gbpusd was consolidating at 1.5580, with fluctuations getting weaker and weaker. We've seen more than once how it all ends. Today's agenda contains Second Estimate GDP in the 2nd quarter – important news for the pair. History shows that the estimate can be much revised in comparison with the preliminary calculations. Anyway, at present analysts don't expect any changes, so be careful at the time of the release.

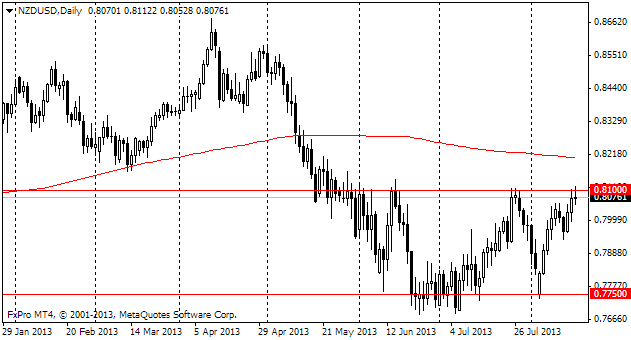

NZD/USD

The Kiwi has been suffering this week. From Friday's peak at 0.8160 the currency has already come close to 0.88, remaining evidently weaker than its rivals. The earthquake has had its part in this of course, undermining business activity and increasing chances that the RBNZ will stick to a softer stimulus policy.

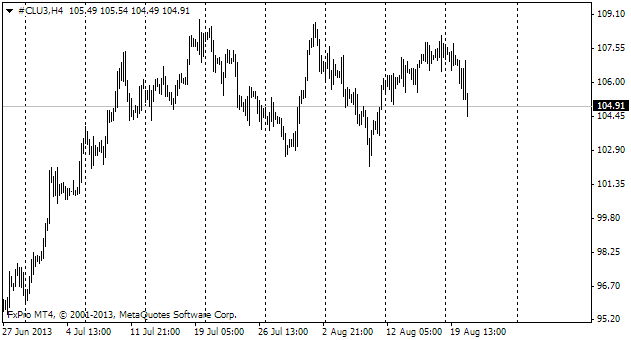

oil

Yesterday Oil was recouping the losses it had suffered a day before. And from the technical viewpoint it succeeded here. Yesterday's candle fully engulfed the body of Wednesday's candle , so in theory it can be a good short-term bullish signal. However, don't rush to push the ‘purchase' button. Now the rates are in correction , remaining below 105.