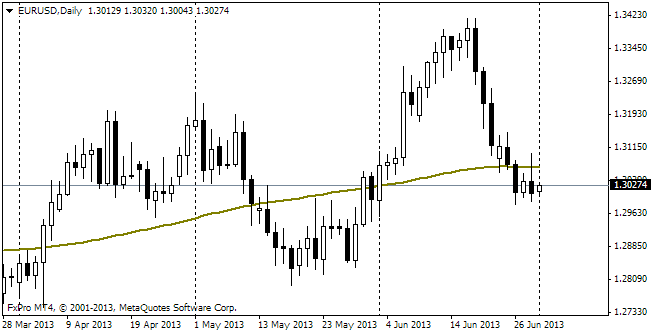

EUR/usd

Having stopped consolidating, eurusd has moved upwards. The pair is testing 1.3600 now, which hasn't been seen since February. Honestly speaking, it is somewhat against our expectations as lately we've observed mainly worsening of the released statistics. This has allowed us to suppose that the growth impulse is dying. Anyway, yesterday traders' attention was all focused on draghi's speech, in which the ECB's governor didn't say a word about the need for measures to improve lending in the region. The euro grew on such claims as before that the CB's members had expressed their readiness to take such a step. Yet, Draghi's speech was quite optimistic. The euro began to grow intensively on his words that the regional economy has resumed growing after six quarters stagnation and decline. It's all right, of course, but such positive shifts don't mean that incentives should be no longer applied. Such an approach was adopted by Draghi's predecessor, Jean-Claude Trichet, when he raised the rate in April and July 2011, after which the eurozone went even deeper in stagnation. Soon on taking the office, Draghi cut the rate and suggested other measures to support lending in the region. If the ECB remains that cool to the economy of the entrusted region, the single currency may continue to grow as for a while we will still see some positive performance. It would be good for Draghi to consider the approaches of the BOE or at least of the Fed, which treat inflation only as a signal that the policy is too soft and the economy is overheated. Upon the whole, the mentioned CBs are drawing the line of the potential economic growth without considering the recession and are trying to get back to this very line, glancing back only to see if there is no overheating in particular sectors. The eurozone is far from such overheating and the appreciating euro only aggravates the situation. Apparently, inflation in the coming months will keep slowing down from the current 1.1% y/y, the same with the economy and the governing board still doesn't feel the need for expansionary measures.

GBP/USD

Britain is slowing down, which immediately tells on the pound. Unlike the euro, the cable began to slow down above 1.6250. The double top may arouse stronger correctional sentiment in the pair. Besides, the economy is gradually showing signs of cooling after the summer heat. Yesterday's Construction PMI dropped down to 58.9 against 59.1 earlier and the expected growth to 60.1. Moreover, the British households are very unwilling to take new credits, which is seen in the record reduction in Housing Equity Withdrawals.

AUD/USD

The aussie keeps living its own life, remaining unaffected by the troubles in Europe and the USA. Yesterday afternoon it managed to appreciate against the dollar from 0.9340 to 0.9400. Thus, the Australian dollar is striving to consolidate at 0.9400. If this happens this week, the Aussie will have a better chance for further growth.

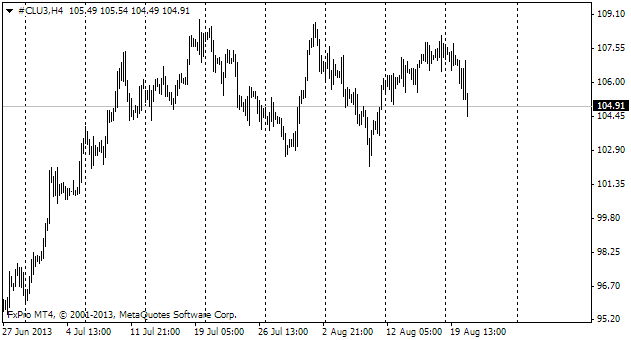

oil

Yesterday Oil recouped its preceding losses, flying up from 101.40 to 104.0 on the fuss of the markets around closing of the US civil services. Despite this we are going to remain bearish in regard to Oil in the near future.