EUR/usd

Americans were again raising the general demand for risks yesterday. As a result, without any particular reason, from the beginning of trading in America, growth of US corporate stocks (except for Apple) was pulling up eurusd. Against the dollar the single currency grew above 1.3300, though consolidation in this area cannot be called strong yet. Earlier, in August, the pair was getting support at these levels, which may serve as a good reason for a fierce fight this time as well. Very often strong supports turn into strong resistances and vice versa. As we wrote yesterday, the European statistics is signaling weakening of the impulse and the US stock market, feeding growth of the pair, may need some rest or correction after seven days of the continuous rise. There aren't many events today, so we can't exclude that the markets may bend under their own weight. Industrial production stats for the euro zone are worth paying attention to today. Analysts have already made up quite a precise estimate of the current situation from the data received from particular countries, so the actual data will hardly differ much from the forecasted rates. Also, there aren't any important US statistics scheduled for today. There will only be a release of weekly employment data, which according to the expectations are likely to show an upward correction after last week's decline.

GBP/USD

The sterling keeps surprising the markets. Yesterday's employment statistics indicated a sudden decrease in unemployment to 7.7%. Though it is not quite clear what exactly is surprising here, as employment was growing for three months before that. The number of the jobless has been declining for much longer – 10 months in a row. So, the initial reaction of the markets (growth of the pound by almost a figure over a few minutes) looks somewhat too strong. And though by now the pair has already gone above Wednesday's highs, this purchasing of the British currency is caused by the dollar's depreciation rather than by strength of the pound alone. Since the beginning of the month GBPUSD has grown already by 330pips and is now just 30 pips from the annual highs.

AUD/USD

aussie-bulls got a hard blow. The employment statistics were like a bolt from the blue for them – the labour market shrank by 10.8K of jobs in August, unemployment grew to 5.8% and the share of the economically active population decreased. All this is very surprising and sad for the pair, which has just tried to prove that it went out from the zone of correction and passed over to the growth phase.

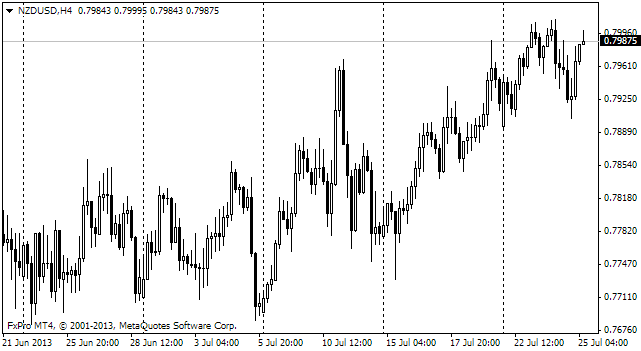

NZD/USD

The Kiwi, on the contrary, didn't disappoint its fans. The release of the commentary on the rate decision aroused a surge of optimism, as the latter contained a hint at the rate increase next year against the background of growing inflation. It should be mentioned here that the head of the RBNZ was gradually preparing the markets for such a turn, making fewer and fewer references to the possibility of the rate cut. We should also add here that considering the current state of affairs in the markets heading for the policy toughening hardly looks unusual. Most likely, Australia will come to the same decision in the coming months.